Women struggle disproportionately with perfectionism. Is it holding you back from investing?

It’s been a long-standing trait of mine that has snuck itself into many an interview as the self-deprecating, humble-brag answer to “What’s your biggest weakness?”

I’m an insufferable perfectionist in many regards. Valedictorian. CFA. CFP. Marie-Kondoing my t-shirt drawer. (Yes, it be like that.) The list goes on.

While there are plenty of ways this tendency has helped me throughout my life and career, it has undoubtedly held me back in big ways.

I’ve hesitated to start new things for fear of failure. I waited until I felt like an expert, so I didn’t look stupid. Meanwhile, I could’ve climbed the learning curve more quickly by taking action.

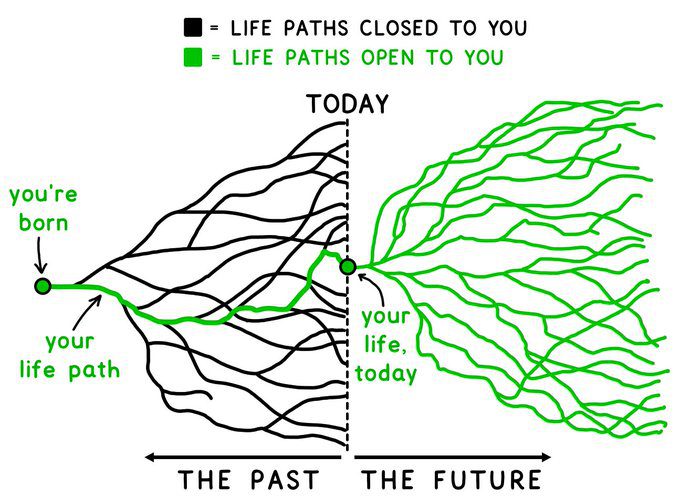

Adam Grant has a genius drawing about the potential paths your life can take. Though there are multitudes, you ultimately can only pursue one. I’d wager my tendency to strive for perfection has led me on a more conservative squiggle below. At times, I’ve avoided taking healthy risks. What if it didn’t go perfectly?

An area of my life where I’ve learned it doesn’t pay to be a perfectionist – through textbooks and over a decade of professional experience – is investing.

If you’re struggling to make moves toward building your investment portfolio, you’re not alone. Here’s why that might be and what you can do about it.

Women struggle disproportionately with perfectionism

Research shows that women demonstrate higher tendencies toward perfectionism than men.

Little girls learn at a young age what earns positive reinforcement from authority figures. We’re not praised for pursuing audacious goals and failing, the way little boys are. We’re not encouraged to be brave, messy, adventurous explorers. Instead, we’re rewarded for being perfect.

Just think of dressing your kids to go out in public. If you don’t have kids yet, think back to your childhood.

If you have a daughter, you probably comb and style her hair (which looks more like a WWE cage match than you’d like to admit). You thoughtfully choose her outfit because she already has big feelings about what she wants to wear. Girlfriend looks READY when she rolls up to the function.

If you have a son, your goal is probably to make sure he’s clean…enough.

Now, think of how your child is acknowledged by other adults when you venture out. Little girls are immediately complimented on snazzy hairdos, cute dresses, and how pretty they look. Little boys get few comments on their appearance. No one is drawing attention to whether or not their hair looks just right.

One perspective on this (that I’m sympathetic to) is that little boys don’t get as much attention, but I’d counter with the point that attention is a double-edged sword. When little girls then aren’t acknowledged – or even worse, when someone is critical of them – it stings. They learn to avoid this at all costs.

The lasting lesson these daily interactions reinforce for little girls is this: Appearing perfect is important. It’s so important, in fact, that it’s the first thing adults mention when they see me. This is just one of the first ways women learn they’re being continuously observed and judged.

The problem perfectionism creates for female investors

What does this have to do with investing? Self-doubt and the fear of “doing it wrong” causes women to delay when we start investing compared to men.

A survey by Transamerica found that women who are already saving for retirement start at an average age of 27. Men, on the other hand, start saving at age 26. Unfortunately, just one year makes a difference.

As of 2020, across all of its retail accounts, Vanguard found that the median balance of women account holders was just $38,000. Men, on the other hand, had an average account size of $49,000. This marks a 29% difference.

In 2022, Vanguard observed an even more pronounced dispersion in defined contribution plans. (These are company retirement plans housed with Vanguard.) The median balance for men was roughly $171,000 and just $119,000 for women. That’s a 44% difference.

This translates to women’s retirement income being just 83% of men’s, making women 80% more likely to live in poverty after age 65. This is according to the National Institute on Retirement Security.

Certainly, there are other factors at play here, like the gender pay gap and men’s propensity to hold more aggressive portfolios, but their willingness to start sooner is a major contributor to the discrepancy in balances.

There’s no escaping it: The more time your money’s invested, the more you will accumulate.

Related Post: Should You Be an Aggressive Investor?

Does this sound like you? Identifying perfectionism in investing.

🎯 Perfectionism stops you from starting investing. This might look like procrastinating because you’re worried you’ll pick the wrong investment for your $6,500 Roth IRA contribution. You spend hours toiling, splitting hairs between three finalist ETFs that are virtually identical. Just a little more research, and I’ll get the answer right!

You pick what seems to be the best choice, and it turns out, you were right! Your ETF goes up by 10 percent over the course of the next year, outperforming the market. Not too shabby! But 10% on $6,500 is only $650, which is almost funny juxtaposed with your family’s joint income of $250,000.

There was never a right answer. There were several that were good enough.

🎯 Perfectionism is waiting until the market drops to buy at a good price. This is textbook market timing and is impossible to do.

The perfect day never comes. What’s much more likely is the market continues to trend up over time, leaving you wishing you would’ve just gotten started.

Don’t second-guess on the sidelines.

🎯 Perfectionism looks like constantly optimizing and tweaking your portfolio. Always striving, never arriving!

I’ll let you in on a little investment management secret. In real life, there’s no such thing as an “optimized” portfolio. Despite the data, charts, and ratios advisors spew about your investments, it’s more of an art than a science. You can spend weeks optimizing a portfolio in a spreadsheet, but all of it goes out the window in real life when investments start fluctuating.

Analysts optimize portfolios with historical data. This info is one of the best indicators for what the future may hold, yet we also know that, by definition, the future will be different than the past.

My pretty cringe investment strategy that got me beyond six figures

My own investing journey had a rather imperfect start.

In my early- to mid-twenties, I did a great job of stashing as much money as I could muster into my 401(k) plan at work. I was a finance major and investment geek, so I understood the benefits of recruiting compound interest to the home team ASAP.

What I didn’t know was how much I could save on taxes by getting money into the right accounts in the right order. Truth be told, I didn’t fully understand how a Roth IRA worked until I was a few years into my career. So, yes, during the absolute ideal years to contribute to a Roth IRA (or Roth 401(k), if you had one) I was doing Traditional contributions.

(As a refresher, Traditional contributions go into your investment accounts before they’re taxed. They reduce your taxable income during that year. They’re ideal when your income is high.)

Since I wasn’t in a very high tax bracket with my starting salary of $50,000 out of college, I would’ve been much better off paying taxes then and then growing my money tax-free in a Roth. Chances are good I’ll be in a higher tax bracket in retirement.

As a now-financial planner, my naivete is equally comic and tragic in retrospect. I’m so thankful, however, that I started without knowing 100% what I was doing.

Had I allowed perfect to get in the way of good, I would have never invested as much when I was so young. In fact, I’d credit my bumbling start as one of the primary reasons I’ve been able to reach coast FI before becoming a mother.

Investing solutions for my perfectionists👌

If you’re hesitant to start investing or find yourself overanalyzing your every money move, here are some suggestions:

- Work with a financial planner who clarifies what accounts to contribute to and what investments to buy. (Like me!)

- In your workplace retirement plans, use investments like target date funds instead of customizing your portfolio. Custom portfolios are rarely better anyway.

- Use a robo-advisor to manage your investment accounts.

- Set up automatic contributions.

I’ll end with a parenting tip to combat perfectionism that I found when conducting research for this post. It’s designed for children, but you can use it on yourself. When self-doubt creeps in, remind yourself of the word ‘yet.’

I can’t zip my jacket (your two-year-old bellows, blind with fiery rage)…yet. I can’t get the cap off…yet. I can’t tie my shoes…yet. Not yet, but you will.

I don’t know how to invest…yet.

Give yourself permission to make an imperfect start, because try as you might, there’s no such thing as a perfect investor anyway. Plus, you’re smart enough to figure this out.

Related Post: How to Start Investing With $10

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.