As an advice-only financial planner, Fidelity Basket Portfolios might be my new BFF for seamlessly managing client investment portfolios.

A long-standing thorn in the side of advice-only financial planners has been implementation of our recommendations. Like it sounds, advice-only financial planners…purely give you financial advice. In exchange, we charge transparent fees, don’t have minimums, and we don’t require you to transfer assets to us to work together.

While I’d argue the advice-only business model is the most objective one, it has limitations.

One of those limitations is expecting our clients to implement the advice we give, especially on an ongoing basis. Investment advice only goes so far when it’s treated like a single-use paper plate. Even worse, clients sometimes pay advice-only financial planners for recommendations only to never actually implement them.

This is precisely where Fidelity Basket Portfolios can come in clutch. Here’s how I’m using it with my clients so they can go forth and prosper!

(Note: I have no affiliation with Fidelity or financial incentive to recommend this tool.)

What is Fidelity Basket Portfolios?

Fidelity Basket Portfolios is an add-on to a Fidelity brokerage account that keeps your portfolio in balance for $4.99 a month. If you’re a DIY investor, this means you no longer need to manually perform tortured calculations and place multiple trades every time you rebalance. In essence, basket portfolios is an ultracheap robo-advisor for DIY investors.

First, you determine what your ideal target portfolio (aka your basket) looks like. If you’re my client, this is where my investment portfolio recommendations come in. Then, you can invest in that desired portfolio in one fell swoop.

Where the basket feature really comes in handy is with one-click rebalancing back to your target portfolio. This makes ongoing account maintenance super easy.

Holdings in a diversified portfolio grow (and sometimes shrink) at uneven rates by design, causing your account to drift out of balance from your target portfolio over time.

Being able to return to your target percentages without launching into spreadsheet hell makes managing a portfolio easy. Like, so easy you don’t need to pay a financial advisor 1% every year to do it, especially if they aren’t giving you fiduciary financial planning advice. But, I digress.

Basket portfolios aren’t necessarily new. Online brokerage platforms like M1 Finance have been offering them for some time. Now, with the advent of fractional share trading, they’re having a moment. Investors with smaller and smaller account sizes can take advantage of this technology that only worked for larger accounts before.

Comparing Costs of Portfolio Rebalancers

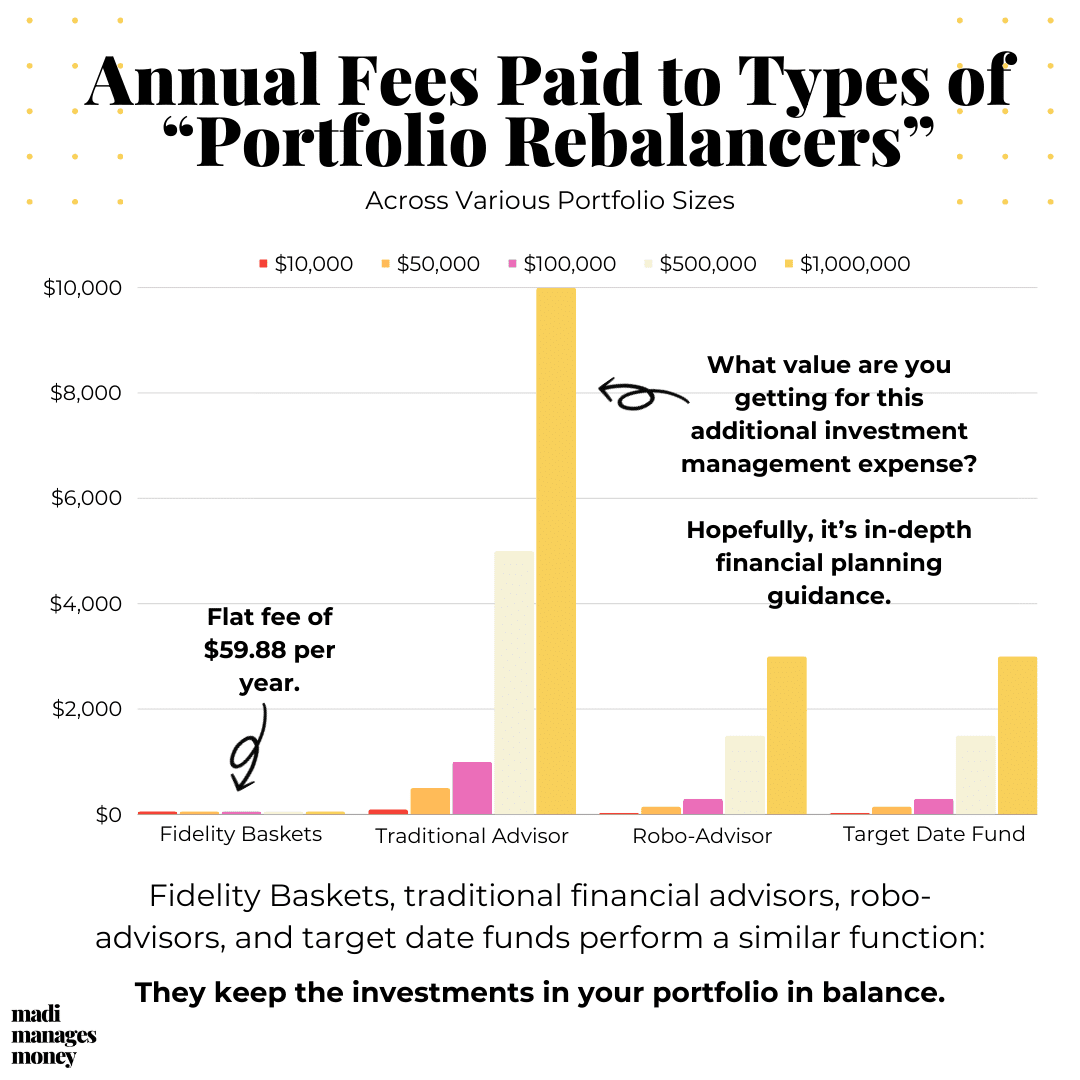

Fidelity Basket Portfolios charges a flat $4.99 monthly fee. That’s less than $60 a year, making it cost effective for small accounts and extremely scalable for large ones.

To measure the basket fee on an apples-to-apples basis, we’ll compare the following “portfolio rebalancers” that theoretically could be used interchangeably, depending on the service model you desire. Afterall, they’re really just different methods to achieve the same outcome: keeping your account aligned with a target over time.

The portfolio rebalancers we’ll be comparing:

- Fidelity Basket Portfolios: $59.88 a year

- Traditional Financial Advisor: 1% of assets a year

- Robo-Advisor: 0.30% of assets a year

- Target Date Fund: 0.30% of assets a year

Let’s address the elephant on the chart. The Fidelity Baskets fee is flat, no matter how much you invest. The other three scale up as you invest more assets, meaning the more you invest, the more you pay, even though the “rebalancer” isn’t necessarily doing more work. (Traditional advisors also use automated rebalancing software on the backend. They’re not burning the batteries out of their calculator for you.)

Pointedly, working with a traditional financial advisor who charges 1% of assets per year is expensive. In fact, the more money you invest, the more expensive it gets.

I’m not here to bash on the traditional financial advice compensation model, but I do want to distinguish what’s valuable and what’s a commodity. Some advisors that charge 1% of AUM are worth every extra penny you pay. This is likely the case if they’re also giving you fiduciary financial planning advice on an ongoing basis. It’s extremely valuable.

Investment management alone, however, is a commodity. If you’ve hired a financial advisor, and the only service they’re providing is investment account management, you could get the same thing from a target date fund, robo-advisor, or Fidelity Basket Portfolios for a fraction of the cost.

An investment-focused advisor might try to spin a sales pitch that their strategy is unique, which is why they’re worth their fee for investing alone. This is #delulu. Try as they might, there’s no secret investment sauce. Their performance is unlikely to outpace the low-cost strategies espoused by the three cheaper alternatives above.

Related Post: Hiring a Robo-Advisor vs. DIY Investing 🤔

Key Limitations & Workarounds

Fidelity Basket Portfolios is an add-on feature for existing Fidelity brokerage accounts, but you can’t place existing shares of account holdings into your basket once you create one. This isn’t the end of the world – and there’s a workaround – but it’s inconvenient. (Especially if you’re neurotic and enjoy a nice, tidy portfolio like me.)

The workaround is this: You can hold the same investment both inside and outside of your basket, all in the same account. They can coexist.

Here’s an example. Let’s say you already hold a share of Apple stock in a Fidelity account. You later decide to use Fidelity Basket Portfolios. The specific share of Apple you already own can’t go into your basket, but you can buy more Apple shares inside of your basket.

You’d effectively have two chunks of Apple in this scenario. One lives inside your basket and is based on your target basket weight. The preexisting share floats freely outside of your basket.

Fidelity Basket Portfolios can only be built with ETF and individual stock holdings – no mutual funds. With the number of ETFs on the market today, you should have no issue finding a comparable ETF for most mutual funds you could dream up.

A maximum of 50 holdings can be placed in your target basket. If this is a limitation you anticipate bumping up against, I probably have more questions than answers for you. But, in fairness, it is a limitation. 😊

My Favorite Fidelity Basket Portfolios Use Case

Fidelity Basket Portfolios is available on most types of Fidelity accounts (like IRAs and HSAs), but I have a favorite. It’s the perfect tool to rebalance a taxable brokerage account that you’re contributing money to regularly.

From a tax perspective, managing a taxable brokerage account requires a bit more finesse than retirement accounts, which are tax deferred. After you sell positions that have gone up in price in a taxable account, capital gains taxes are due on appreciation (usually at a 15% rate). In your retirement accounts, you can buy and sell positions freely with no tax consequences until you take money out of your account.

Since taxes are a factor, I like to get more granular when building taxable account portfolios. This gives clients more control to choose which holdings to sell come time to withdraw money. It can also open opportunities to harvest tax losses, if you wanna get fancy.

Fidelity Basket Portfolios not only enables you to rebalance your account when positions drift, but it also makes it easy to allocate new money to the right spots when you contribute to an account. Rebalancing as you make contributions is the most tax-efficient way to manage a taxable brokerage account. By placing new money into your most underweight holdings, very rarely do you have to sell your winners to redistribute money.

That’s exactly what the Fidelity Basket Portfolios ‘Smart Buy’ feature does. When you contribute money, Smart Buy will automatically invest it in your underweight securities. If you set up a recurring investment (which is a capability, bless up), this will effectively eliminate selling winners (and realizing capital gains taxes) unless there are extreme market movements.

Forgive my bias, but I’ll wrap with an ideal playbook:

- Get fiduciary investment portfolio recommendations from an advice-only planner for a flat, upfront fee

- Establish Fidelity Basket Portfolios in your taxable brokerage account

- Set up a recurring investment into your taxable brokerage account

- Keep your portfolio in balance automatically, even as it fluctuates, without paying 1% a year for ongoing management

Madi 💛

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.