This article explains how to start investing on your own with just a few extra dollars.

I’m writing this under the bold assumption that most readers are in your 20s and 30s and starting to invest for long-term goals, like retirement or a young child’s college education.

Here are 5 steps to get started.

Step 1. Determine how much to invest

A common misconception is that you need a couple-thousand-dollar chunk of change to plunk into the stock market for it to be “worth” starting. I’d argue the reverse is true – putting small amounts into the market is how you get that couple-thousand-dollar chunk of change.

You could actually start investing with as little as $10.

To get you as amped up at this prospect as me (oye, lookout), here’s what investing could do for you. Starting when you’re 30, if you invested just $10 per month for 35 years, you’d have nearly $23,000 at 65.

The remarkable part is that you would’ve only deposited $4,200 to the account. The remaining ~$18,000 is all investment growth. 🤯 (This assumes you were able to earn an 8% return.)

Whatever the amount you start investing with, you want it to be money that can stay in the market for a longer period of time. Generally, I classify longer-term as ten years or more.

Avoid investing anything that you might need for short-term goals. For example, your emergency fund doesn’t have a place in the stock market. Similar logic applies to money you have squirreled away for major purchases within the next few years.

I’d suggest keeping short-term investments in a safer place, like a high-yield savings account.

Step 2. Choose an online brokerage platform

Assuming that you want to start investing completely online and not through a financial advisor, you have two options.

- Select a discount broker.

- Select a robo-advisor.

Here’s the skinny on each.

Discount Broker

“Discount” brokerage just means that you’ll be investing completely on your own through a website instead of working with a financial advisor.

Like the name implies, one of the benefits of starting to invest with a discount broker is that it’s generally your most cost-effective choice. It’s also a good choice if you’re starting out investing with a smaller amount of money.

The cons of using a discount broker? You’re completely doing it yourself.

Managing your own account is totally doable, especially if you structure your portfolio in a smart way that’s easy to maintain. The last thing you want is to feel compelled to log into your account to regularly trade.

I’ll share with you how I invest my money so that it’s diversified and essentially on autopilot in next week’s article.

Some platforms I’d suggest are Fidelity (my personal fav) or E*Trade. Note that I have no relationship with either.

Robo-Advisor

A robo-advisor uses an algorithm to suggest a diversified investment portfolio that fits your needs. The platform then manages it for you on an ongoing basis.

The website will ask questions to gauge how comfortable you are with taking risk and when you plan to use the money. Some programs even provide socially conscious investment portfolios today.

Think of a robo-advisor as the middle ground between completely doing it yourself online and working with an in-person financial advisor. Cost-wise, it’s also situated between those two options.

If you’re feeling unsure about managing your investments completely on your own, consider this option. Having a second set of figurative, robot eyes on your investments might be worth it for the peace of mind alone. 🤖

A reasonable ongoing management fee to expect is 25-30 basis points (which is equal to $2.50-$3.00 for every $1,000 you invest with them).

Betterment is a solid robo-advice option that allows you to start with just $10. I have no affiliation with Betterment.

Step 3. Pick the account type

I find that this is the step in the process that’s most susceptible to analysis paralysis, so we’ll keep this super simple. Follow this rule: pick the type of account that maximizes your tax savings.

There are three common account types for starter investors:

- Traditional IRA

- Roth IRA

- Taxable Brokerage

IRAs get ~special~ tax treatment from the IRS, so these should be your first choice. Decide if one is right for you based on how much money you (and your partner) make. (I’ll link the IRS page that details the rules at the bottom of this article to help you decide.)

Traditional IRAs reduce your tax bill in the current year, whereas Roth IRAs reduce your tax bills in retirement. Both types of IRA defer the payment of any taxes when you sell investments at a gain as long as the money stays in the account.

Your other option is a taxable brokerage account. This account doesn’t get any ~special~ tax treatment by the IRS, but it’s super versatile and can be opened by anyone without limitation. In this type of account, you’ll owe tax when you sell investments at a gain.

Getting started is the most important part. Flash forward five years from now. You’d be kicking yourself for not getting that money invested, not worrying about if you were tax-optimized when you did it.

If you do really want to get freaky with tax-optimization, read this post on Order of Account Funding.

Step 4. Deposit money

Once your account is opened, you can deposit money directly from your bank account. Again, you can actually start investing with as little as $10.

A pro-level move is to set up a recurring deposit & investment plan. Research (and math!) shows that investors who make scheduled, routine monthly investments outperform otherwise identical investors who invest less frequently.

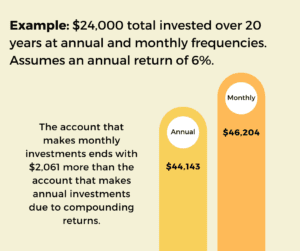

In the example below, both accounts invested $24,000 over 20 years and earned a 6% rate of return.

The monthly investor ended with $2,000 more than the annual investor just from more frequently investing regular bits. This is because of compound interest! 💃

After landing in the account, note that your money will be waiting in cash. It does not automatically invest.

Step 5. Invest your money

The final – and distinctly separate – step is to actually buy an investment with the cash you deposited.

If you chose the discount brokerage route, it’s time to zip up your Patagonia and get to work researching. (Just kidding. Next week’s article will explain an easy framework to pick investments on your own. No vest required.)

If you want to get cracking in the meantime, here are a few investment selection guideposts:

- Opt for diversified, low-cost index funds for your first time investing. Low-cost index funds tend to outperform higher-cost active managers. They’re also much easier to select and monitor than individual stocks.

- Align your investments to your long-term risk tolerance. If you’re in your 20s or 30s and investing for retirement, your account should mostly be invested in riskier investments, like diversified stock index funds (as opposed to bond funds).

- If investing feels hard, you’re doing it wrong. Managing your portfolio on an ongoing basis should take little to no effort.

If you chose a robo-advisor, confirm that your money is indeed invested according to the questions that you answered when you set the account up. Otherwise, you’re golden!

My challenge to you

To finish, I present you with a challenge: Invest before you feel completely ready. That might sound a little reckless, but the first steps toward a big goal are always clumsy.

I made my fair share of mistakes in my early investing days, but you know what? I’m happy I did, because at least I got the ball rolling.

It’s safe to say that I missed out on some tax benefits and poured *way* too much energy into picking investments. (Had to make that extra 5% gain on my $1,000 position, ya know? 🙄)

I do, however, have thousands of extra dollars to my name because I was willing to enter the arena before I completely knew what I was doing.

Waiting for the “perfect” investment or moment to begin is a trap. The same goes for feeling like you need to have full and complete knowledge of how markets work to get started.

You’re smart enough to learn as you go, so get in there and make mistakes! And by that, I really mean DM me the second you feel confused. 😂

Resources:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.