A financial advisor would charge you 1% to build a fully diversified, low-cost portfolio like this.

I’d know, because I’ve spent most of my professional career managing client investment portfolios on their behalf.

After reading, you’ll walk away knowing how to DIY a fully diversified, low-cost portfolio of index funds that’s easy to maintain. This framework also mirrors how I manage my own money as a long-term investor who buys & holds.

Zip your Patagonia, lace up those boat shoes, and prepare to introduce some new terms (like “low-cost globally diversified index funds”) to your Google search history. Here’s how to build a diversified, low-cost portfolio like the pros.

The paradox of diversifying with ONE investment.

We begin with a hot take. 🌶 You can build a fully diversified, low-cost portfolio with just one investment.

If I just sent you spiraling into a flashback – one of that recurring lecture your dad gave you about not putting all your eggs into one basket – hear me out.

Certain ETFs and mutual funds are designed to be a complete portfolio in and of themselves. As an example, Vanguard Total Stock Market ETF (VT) is the only holding in several of my accounts that are over six figures. Likewise, this single-holding strategy can be applied even if you’re just starting investing.

As an equity market investor, it has all of the diversification that I need right in one holding. To be exact, it provides me with exposure to over 9,500 stocks across more than 40 different countries, including the U.S.

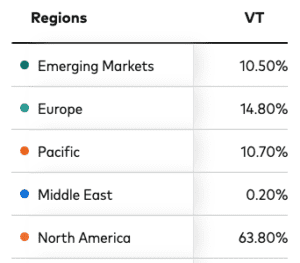

Exposure of Vanguard Total Stock Market (VT) as of 9/30/2022.

The underlying mix of investments (~60% to U.S. stocks & ~40% to international stocks) is on par with the portfolio you’d get if you’d hire a financial advisor to manage it for you.

But, instead of paying 1% like you would to an advisor, buying & holding an investment like this keeps your account in balance for a fraction of that cost. In the case of Vanguard Total Stock Market (VT), that cost is 0.07%.

To be fair, there are some huge benefits of working with a financial advisor, but investment outperformance is not one of them, especially for a buy & hold investor who is just getting started.

Control the controllables: keep expenses below 0.20%.

Very few things are guaranteed in finance, with one important exception that springs to mind: expenses. With certainty, I can tell you that the expense ratio charged by your funds will reduce your returns.

The expense ratio is the fee that the fund manager charges to, well, manage the investment. Knowing that fees definitely reduce returns, a smart investor would look to minimize them (or at least only pay up if the value’s there).

*Passive index funds enter the chat.* 💬

Passive investments that track an index charge lower expenses than actively managed counterparts. Considering that their job is to literally replicate an index – they’re not trying to beat the market – it makes sense why their fees are lower.

The surprising part? Low-cost index funds actually tend to outperform your average active manager. (If they were human, they’d be that person who’s effortlessly good at everything.)

In spite of intense research, effort, and trading on the active managers’ parts, the average underperforms the index by roughly the expense ratio they charge.

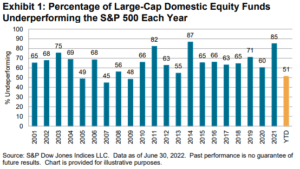

The chart below shows the percentage of U.S. large-cap stock funds that underperformed the S&P 500 Index over the past 20 years. As you can see, it ain’t pretty for the active managers – rarely have they bested the S&P 500 Index.

SPIVA U.S. Mid-Year 2022 from S&P Dow Jones Indices.

I share this with you because I don’t want you to feel like you’re missing out on gains by forgoing active management. The same goes for trying to actively manage a portfolio of stocks yourself.

It’s natural to wonder, What if I took that gamble and ended up picking a winner? but probability and history both say that you’d be stacking the deck against yourself. You’re better off creating a diversified portfolio of low-cost index funds.

How low is low-cost?

As a guidepost, look for index funds with expense ratios below 0.20%. (That’s 20bps for those of you in your Patagonia & boat shoe costume.) Should you find a passive fund that costs more, chances are good there’s a cheaper option out there.

This figure is based on the following average management expenses of stock indexes from 2021.

- ETF average: 0.16%

- Mutual fund average: 0.06%

(A link to this research report by Investment Company Institute is at the bottom of the article. The averages are asset-weighted.)

An investment that charges a 0.20% expense ratio is charging you $2 in management fees for every $1,000 that you put in that investment. To outsource keeping your portfolio in balance over time, that’s affordable.

Pick a manager with big assets.

Building a diversified, low-cost portfolio isn’t the time to patronize a trendy boutique on Small Business Saturday. You want to shop the big players in index fund investing, like Vanguard, Fidelity, and BlackRock, among others.

Economies of scale lowers fees for end investors, like you and me. The more assets in a mutual fund or ETF, the more that fixed costs can be shared.

Scale has other benefits, too, like better liquidity. Funds with more assets tend to have a larger market of buyers & sellers on any given day.

Adequate trading volume like this increases the chances that there’s a buyer in the market willing to purchase your shares when (and if) you sell. That’s a good thing.

Keep it simple.

The more streamlined you keep your portfolio, the easier it is to manage on an ongoing basis. By adopting the approach of picking just one to two fully diversified investments, you can effectively put your account on autopilot.

👆We’ve already established that ETFs and mutual funds exist that are complete portfolios in and of themselves.

As you add more of these to your account, you’re adding layers of complication with little to no additional diversification benefit. You’re also signing up for the task of checking and rebalancing your hodgepodge (the technical finance term) on an ongoing basis.

And lastly, for the love of all that is holy, avoid trying to pick individual stocks. That’s the antithesis of keeping it simple. 😵💫

You’d need to buy at least 30 stocks to be minimally diversified. Thoroughly researching enough companies and then following them on an ongoing basis is a full-time job.

1/10 only recommend if you’re a glutton for punishment and like to underperform the stock market.

Where to conduct research: tools & resources.

I rely on Google for a lot of research these days. A search for “low-cost globally diversified index funds” should yield you some ideas to build a low-cost, diversified portfolio.

Beyond that, I recommend going to asset managers’ websites (like the three biggies mentioned above) and pulling up investment factsheets. A factsheet is one to two pages covering the most important details of an investment, like what it holds, how much it costs, and the amount of risk it takes.

Morningstar.com, even the free version, is a helpful website for comparing investments across different fund companies. Further, the online brokerage platform where you opened your account is likely to offer some research functionality.

Here’s what your DIY portfolio should look like.

Your account should hold one to two fully diversified, low-cost index funds from a big-name manager, like the Fidelitys, Vanguards, and BlackRocks of the world.

It matters little if you pick an ETF vs. a mutual fund; what’s more important is that the expense ratio that you’re paying is below 0.20%.

If you’re in your 20s or 30s and saving for a long-term goal like retirement, you’re holding mostly stocks. Your investments should be a mixture of both domestic and international markets for thorough diversification.

You have a set-it-and-forget-it portfolio. Because you’ve structured it with a couple holdings, at most, you don’t need to worry about it drifting with the market. You’ve effectively outsourced keeping the account in line to the manager of the fund that you picked.

This strategy works regardless of how big or small your account balance is.

Conclusion: If you’re bored, you’re doing it right.

Investing this way doesn’t get the attention it deserves for a reason: it’s f*cking boring. It’s so boring that the hardest part is resisting the temptation to tinker your strategy.

Most women set out with the preconceived notion that investing must be harder than this. After all, negative finance bro culture alludes to a lot of hustling, being in the know, and stock market wizardry.

I’ve walked among them, and I’m here to tell you that it is actually this easy. You’re doing it exactly right.

Supporting Research & Resources:

- Related blog post – ETFS & Mutual Funds: Understanding the Main Differences

- S&P Dow Jones Indices – SPIVA U.S. Mid-Year 2022

- Investment Company Institute – Trends in the Expenses & Fees of Funds, 2021

- Morningstar.com

(A note on portfolio risk: I’m 33 with at least 30 years until I’d even consider using this money, so I stay fully invested in the stock market. If you have a shorter investment time horizon (e.g. less than 15 years), an all-equity portfolio may be too risky for you. Consider diversifying further into asset classes that have historically provided lower risk and lower returns, like fixed income.)

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.