Remember the kid next to you in Algebra 1 that copied your homework, whose dad said he’d never need to know this stuff anyway? If you were an uptight overachiever like me, this is your chance to get the last laugh.

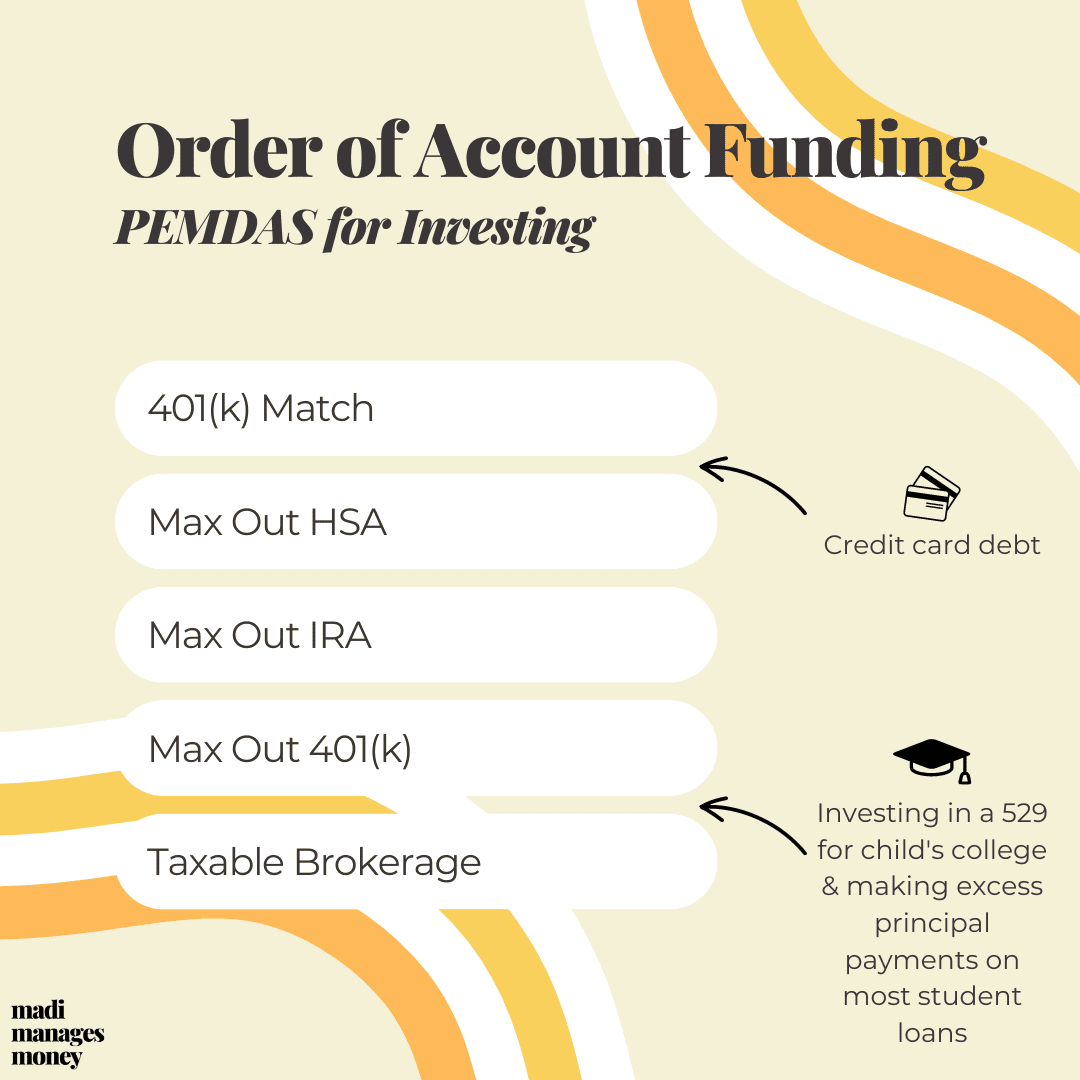

Here’s the optimal order in which to fund your accounts to maximize tax savings and investment growth, now and in retirement.

Think: Please Excuse My Dear Aunt Sally (PEMDAS) for investing.

First thing’s first. You’ve determined you’re ready to invest.

- Your emergency fund is locked and loaded with 3-6 months of living expenses.

- You’ve paid down high-interest-rate debt (credit cards👀).

- You have some excess cash flow.

Now comes the exciting part: building wealth by investing the excess, following the order outlined below.

Each year, make it your goal to reach as far down on the list as you can. If a step isn’t available to you, all good. Skip to the next one.

Contribute just enough to your 401(k) to get the match.

The first order of business is contributing just enough to your 401(k) retirement plan at work to take full advantage of your company’s matching benefit. This is the “free money” part people are always talking about.

(Nonprofit friends, apply this logic to a 403(b) just the same!)

How does it work? You contribute some of your earnings, and then your employer matches your contribution.

If your company matches 1:1, dollar-for-dollar, you’re essentially earning an immediate 100% return on your money. That’s hard to beat!

Even if your company matches 50% of the amount you put in, that’s still a 50% return.

Any of your paycheck you contribute is always yours. Money your employer contributes on your behalf, however, becomes yours once you’re vested. This happens once you’ve worked for a company for a few years.

Think of your employer match as part of your total compensation. By not contributing enough to your plan to get it, you’re effectively choosing to leave some of your salary on the table.

Your match is one of the biggest benefits of working for a 9-5 job, adding up to thousands of dollars each year. Take full advantage of it!

Max out your health savings account (HSA).

A HSA is a tax-advantaged investment account that gets ~special~ treatment if you use the money for healthcare expenses. It’s kind of like an IRA for healthcare but even better. You’re eligible to contribute to one if you have high deductible medical insurance.

The HSA is sick 🤙 because it gives you a triple tax benefit.

- You get a tax deduction when you contribute money. You can contribute $3,650 as an individual or $7,300 as a family in 2022.

- Money in the account grows tax-deferred.

- As long as you use the money for healthcare expenses, it’s never taxed.

You can access this money at any time for healthcare expenses, but if you can swing it, I actually recommend that you don’t use this money to pay as you go.

By leaving it invested instead, you’re maximizing your triple tax benefit. Since it will never be taxed as long as you use it for qualified healthcare expenses, you want to maximize its growth.

None of us are likely to have any shortage of healthcare expenses in the future. Demographic & healthcare cost trends coupled with the tax benefits put this account type pretty high in PEMDAS for investing.

Max out your IRA.

Next, you’re filling up your IRA bucket. For 2022, you can contribute a total of $6,000 into an IRA if you’re younger than 50. In 2023, that amount will increase to $6,500.

Unlike your 401(k), an IRA isn’t offered by your employer. Instead, go to a brokerage website to open one up. If you need help getting started, follow these instructions from a recent blog post.

IRAs are easily accessible, have lower administrative fees than a 401(k), and provide you with a wide array of investment choices.

There are two types that you can choose from: Traditional or Roth. We could do an entire article on when to choose which one, so I’ll keep this as brief as I can.

Picking the type that’s right for you boils down to the amount of money you make today.

Check these IRS income limits to see where you land, or ask your accountant to help you determine which is right for you based on your modified adjusted gross income (MAGI).

A Traditional IRA will defer taxes until you use the money in retirement. At that time, you’ll owe income taxes on all money you withdraw from the account.

If you’re below the income limits (linked above), you might also be eligible for a tax deduction now for your contributions.

If you’re a higher earner, on the other hand, you won’t get a current-year deduction. You can, however, still contribute to this account to take advantage of tax-deferred growth over the years.

(Tax-deferred growth means you won’t be on the hook for taxes on investment transactions, including dividends, while money is in the IRA. This might not seem like much at first glance, but it’s actually a huge deal. We’re talking a difference of tens of thousands of dollars over time.)

A Roth IRA is like the mirror image of a Traditional IRA.

There’s no deduction for contributing; you’re contributing money you’ve already paid taxes on in the current year.

The ~special~ part we like? Money in a Roth grows tax-free, forever, as long as you use it after 59.5.

Again, your income limits are a consideration. If you make above a certain amount, you could be precluded from contributing to a Roth all together.

If you’re eligible for both types of IRAs with no limitations, here’s where my mind goes. A Roth IRA is probably the better tax diversification play, especially if you’re planning to max out your 401(k).

Money that you invest in a Traditional IRA and 401(k) is tax-deferred but not tax-free. You’ll pay taxes on money you withdraw from them some day – and withdraw, you will.

The IRS will require you to do so through required minimum distributions (RMDs) when you reach 72. They want their tax revenue, so they don’t let money sit in these accounts forever.

A Roth is an opportunity to funnel some assets into a tax-free bucket for future you. 👵🏼 This gives you extra flexibility on how much of it you decide to use and when you want to use it.

Max out the rest of your 401(k).

Back to your 401(k) to max it out. In 2022, the maximum amount you can put into your 401(k) is $20,500. For 2023, that goes up to $22,500.

Filling this account up maximizes the tax deduction you’ll get in the current year, which can be sizable.

Assuming you’re in the 22% marginal tax bracket and you max out your 401(k) in 2022, that puts ~$4,500 back in your pocket that you would have otherwise paid in federal taxes. That tax savings doubles if your partner maxes out their plan with you.

Any of the money that you’ve invested here will grow tax-deferred until you use it in retirement.

Send the rest to your taxable brokerage account.

If you’ve made it this far, you’re really getting after it. 😎

Plow the remainder of your excess cash flow into a taxable brokerage account. Here’s a guide from a previous blog post on how to open one.

While there aren’t any explicit tax breaks for investing in a taxable brokerage account, you do want to invest, not just save. That way, your wealth grows over time instead of being eaten by inflation.

Further, because the IRS doesn’t give this account any ~special~ tax treatment, they don’t care when you use the money or how much you contribute. This gives you a lot of flexibility.

As you buy and sell investments, you’ll owe capital gains tax on any investment gains. As long as you’re investing for the long-term, the account will be taxed at a more favorable capital gains rate, which is more often than not 15%.

Where Other Financial Goals Fit in PEMDAS for Investing

I’d like to invest for my children’s college with a 529.

I’ll start with my cyborg financial planner answer and then follow with a more human one. 🤖 You can use this intel to make the choice that’s right for your family.

The math says paying for college comes after maxing out your 401(k) and before your taxable brokerage account.

This might place college lower on the totem pole than you were expecting.

Pushing college savings too high in PEMDAS for investing could cause you to miss out on thousands of dollars in federal tax savings (that you could then, in turn, put in your kids’ 529s). It also commits money to the specific goal of paying for college.

But, I also totally get it. Paying for college is a financial goal that’s near and dear to millennial parents’ hearts. It’s something I’ve given some thought to, shared here in this blog post.

I have debt.

This answer depends heavily on your interest rate. A general rule of thumb is to ask yourself, Can I make more on this investment than I’ll pay in interest?

Let’s start with credit card debt, which is the most straightforward. Given the high interest rates charged to carry balances, you want to aggressively pay it down right after taking advantage of your 401(k) match.

If you have student loans, assuming your interest rate is somewhere in the 5-6% range, bucket your payments into two categories:

- Required monthly payments

- Excess principal payments

Your required monthly payments are nonnegotiable, so they go at the very tippy top of PEMDAS for investing.

Excess principal payments are a different story. Don’t feel like you need to completely pay them off before you start investing.

If you’re someone in your 20s or 30s who primarily invests in stock market indices, history has shown that by staying the course, you could expect somewhere in the 7% range of returns over the long haul.

For this reason, I’d place paying excess principal of your student loans between maxing out your 401(k) and taxable brokerage.

The same logic applies to mortgage payments.

At the end of the day, we’re *optimizing*.

If you were doing more of a DASPEM than a PEMDAS for investing in the past, no need to freak out.

You did the hardest, most important part, which is just getting started. Don’t let perfect be the enemy of good.

Lastly, make this easy on yourself. If you earn a salary, plan how much you should put into each of these accounts from your paychecks early in the year.

Design your system to make progress towards filling multiple accounts simultaneously as the year goes.

That’s a lot easier, and will lead to better investing results, than remembering to turn contributions on and off for one account at a time. Plus, we all know that there’s no one better at doing five things at once than a mom.

Thanks for reading. 💛

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.