This article provides the following:

-

How much student loan relief may change your monthly finances

-

How much $10,000 to $20,000 could become

-

A playbook: how to convert student loan relief into wealth

In case you’ve been living under a rock, Uncle Joe broke the internet last week, and it wasn’t from leaked nudes (although that may have done the trick, too).

The Biden Administration announced that student loan relief would be available to an estimated 43 million borrowers. That’s 13% of the U.S. population.

Borrowers with loans held by the Department of Education that made less than $125,000 in 2020 and 2021 are eligible for $10,000 in loan forgiveness.

Pell Grant recipients, even if it was only for a portion of college, are eligible for an additional $10,000 in relief, totaling $20,000.

Note: The $125,000 income limit is based on your adjusted gross income (AGI). This means that even if you earned over the limit in 2020 or 2021, you might still be eligible if you were contributing to accounts like your 401(k) and HSA. Contributions to these accounts lower your AGI.

Income-based repayment plans will now cap repayment at 5% of your monthly discretionary income for undergraduate loans, compared to the previous 10% cap.

Lastly, original loan balances of $12,000 or less will be forgiven after 10 years instead of 20.

This could mean a huge swing in finances for millions of folks in their 20s and 30s, early enough in our lives to make this amount of money a game-changer, if you make the right moves.

How much can student loan relief change my monthly finances?

For starters, let’s establish what debt relief will look like when it gets here.

There’s not going to be a $10,000 lump sum that hits your bank account. Instead, this is going to feel more like a slow build than a windfall.

If your loan balance is paid off completely, voila! Your existing monthly payment will go away.

If your principal has been reduced but a balance remains, it could look one of two ways. Either the monthly payment that you’re required to make will be reduced, or you’ll be required to make your same monthly payment for a shorter period of time.

For example, if your loan was going to take 15 years to pay off before, that time period could be shortened by 5 to 10 years.

Either way, it means your monthly cash flow situation will be getting a glow-up sooner than you expected it.

To help you quantify how much your situation will change, let’s consider what the average borrower has on their plate.

As of January 2022, the average federal student loan balance was about $37,000. For most, that would take 15 years to pay off with a monthly payment of about $300. This assumes an interest rate of 5%.

If that borrower’s principal was reduced by $10,000 to $27,000, they could expect one of the following:

- Their monthly payment becomes $220 (~$80 reduction)

- The time it takes to pay off their loan is reduced from 15 years to less than 10 years

If that borrower’s principal was reduced by $20,000 to $17,000, they could expect one of the following:

- Their monthly payment becomes $140 (~$160 reduction)

- The time it takes to pay off their loan is reduced from 15 years to about 5.5 years

In the Resources section at the bottom of this article, a calculator is provided to help you estimate more closely how your situation may change.

What could $10,000 to $20,000 in relief become?

Now, what to do with this money that didn’t exist to you just a few weeks ago? I’d use it to level up. 🥷

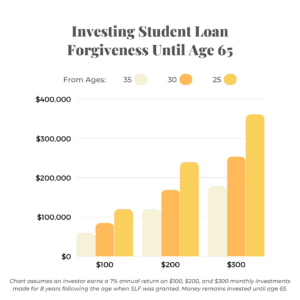

Assuming that you’re between the ages 25 to 35, you have a reasonably long time horizon until you retire.

Knowing that, our investment plan for this example will be to purchase a diversified stock index fund. We’ll assume that you’ll hold it until age 65 and can earn 7% per year.

To mimic the future money making a reappearance in your pocket, you’ll make monthly investments for the first 8 years of this timeframe only. It adds up to the following principal amounts:

- $100 monthly: $9,600 total investment

- $200 monthly: $19,200 total investment

- $300 monthly: $28,800 total investment

By following these steps, it’s totally feasible for you to turn “relief” into over six digits by age 65.

A Playbook: How do I convert student loan relief into wealth?

Here’s how you do it.

Phase 1: Aggressively pay off any high-interest rate credit card debt. When I say aggressively, I mean as aggressively as you wet-lined your bottom lid eyeliner in 9th grade.

Phase 2: Assuming you have earned income, open up and contribute to a Roth IRA. In 2022, you can contribute up to $6,000 to this type of account. In 2023, that will go up to $6,500.

Any growth you enjoy on your Roth money will never be taxed again, as long as you wait to use it until you’re 59.5. You can access your contributions freely at any time.

Phase 3: Review your contributions to tax-favored accounts, like your Health Savings Account (HSA) and 401(k)/403(b).

With less money going out the door towards student loans, you should have some extra cash flow each month. See if you can bump up your contributions.

401(k)s and HSAs get ~special~ treatment by the IRS. You get a deduction for contributing money, which can save you thousands in taxes each year.

(These deductions also reduce your AGI, which as we know now, is critical for benefitting from forgiveness or stimulus. Ya never know when this could come in handy!)

By bumping up your contributions, you’re amplifying your student loan relief to the tune of a few thousand bucks every year.

Phase 4: Still have money left over after maxing-out the accounts above? Welcome to the big leagues, Beyonce.

In this phase, you have some options based on your situation and preference. You could:

- Invest in a 529 account for your kids

- Pay down your remaining student loans

- Invest in a taxable brokerage account

There’s not really a wrong answer, but I’ll give you some guiding principles.

- Let the interest rate on your student loans inform your decision. If it’s higher (like ~6%), consider paying them down more quickly. If it’s lower (like ~4%), consider continuing to make regular payments only. The momentum that you’re feeling right now from having a chunk of your loans wiped away is very real. If you wanna take it and run with it, go for it!

- If you’re planning to give your kids money for college, putting it off until later is a trap. You have 18 years, at best, to invest money for them. The earlier you do it, the easier it will be. Here are some estimates of what you should expect to save.

Sign me up.

Student loan forgiveness is an even bigger deal than $10,000 or $20,000 if you make it count. As the adage goes, you need to have money to make money.

As unfair as that feels, it’s true. The good news is that you’ve just been granted a five-figure swing to your net worth early enough in your life to make the saying work for you.

An application should be ready by October, 2022. Relief is expected to be reflected in your loan balance within 4 to 6 weeks following its submission.

The administration suggests that applications are submitted by November 15th to see relief by the end of the year.

I’m speculating, but this seems like a tight timeline. I’d hope for the best but prepare for the worst.

With this playbook, you’ll know what to do, whether relief hits your account around the holidays or shortly after. I’m excited to see how you use it!

Resources for You:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.