Millennial parents are faced with quite the conundrum. Do we save for our children’s education or invest for our own retirement?

You love your kids, but you also deserve to live your life. And, this goes without saying to my millennial comrades: tuition isn’t cheap. Many of us still have student loans of our own to pay.

I’ll give you the business up front. The short answer is that you should prioritize yourself by saving for retirement. Parents, before you write me off as cold-hearted and calculating, hear me out.

This article makes a case for prioritizing yourself while outlining strategies to actually save and invest for both. We’ll cover how much to invest each month and why (in my humble opinion) you shouldn’t pressure yourself to pay for all of their tuition.

With a game plan, you’ll be able to accumulate more than you think!

The Case for Prioritizing Retirement

Think about this. Retirement is literally the only financial goal that you can’t borrow money to accomplish.

Buying a house? Mortgage. Need a new retaining wall? Use your home equity line of credit. Going to college? Student loans.

Planning to spend the last 20 years of your life not earning money, on a spending spree not seen since the likes of Anna Delvey? Lenders aren’t lining up for this opportunity.

More to that end, we’re gonna live for a long time. On average, our golden years will be longer and more expensive than generations before.

How expensive? To put numbers to it, I’ll use my family as an example. My husband and I are 32.

According to the good ole Social Security actuarial tables, my life expectancy is 82 years old. Assuming I retire at about 65, that leaves us with 17 years to pay for.

Let’s say my husband and I plan to spend roughly $70,000 per year in today’s dollars during those years. (That’s a little above what we actually spent in 2021.)

To do that, we’ll need at least $1.5 million squirreled away when we enter retirement in 33 years. To get to that magic number, we have options:

- Invest at least $170,000 in a lump sum today, or

- Invest at least $14,000 every year

That’s about $1,100 we’d need to invest per month, from now until we’re 65, to have enough money to retire.

Given our time horizon, we’re willing and able to take on more aggressive investment risk, so the figures assume we can achieve a 7% return on our investments.

It also assumes we’re utterly dead-ass broke 💀 when we pass, and that our Social Security income and taxes virtually net out in retirement.

This is no-frills. It doesn’t include future gifts or travel. It doesn’t consider if my husband and I were to have a health event that wouldn’t be covered by insurance. Lastly, it assumes that I die when I’m supposed to. 😊

Even a barebones retirement spending plan like this illustrates the point that getting old is gonna cost beaucoup bucks.

Wanna Give Your Kids a Full Ride? Run the Numbers.

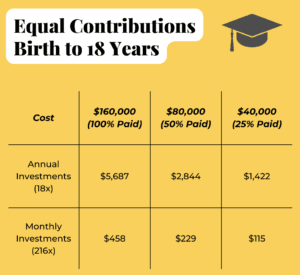

Assume that your child would need $20,000 per academic year in today’s dollars for school in 18 years. (Sorry, kid. Headed the public university route. Private would run us closer to $35,000 today.) This feels like a reasonable, middle-of-the-road example.

Baking in a 4% inflation rate, that $20,000 will be more like $40,000 in 18 years. To ballpark, $160,000 is the total they’ll need for a four-year public university.

If you invest in a 529 account and expect to earn an average 5% per year in it, you’d need to contribute about $5,700 annually, starting the year they’re born, to fully fund the $160,000.

That’s about $460 contributed *every month for 18 years* for one child.

If you’re a family with two children, investing for your barebones retirement, plus their full college tuition, you’re investing over $2,000 per month just to meet those goals.

Millennial Parents: College Costs Have Us in Our Feelings

If I haven’t already triggered you with the math, strap in.

Numbers aside, let’s talk about the millennial experience (translation: trauma 😩) around the cost of college, and how that can play into choices we make for our own kids.

For most millennial parents, planning for this strikes a nerve, and one could say we’ve got range.

On one end of the spectrum, some of us harbor resentment toward our parents. They didn’t have the foresight to prepare us financially for college. Money wasn’t put away for it, and at the very least, they could have helped us make better financial choices.

Many of us had ZERO concept of the magnitude of debt that we took on. Absent of financial education or parental guidance, we took cues from our peers. It seemed like everyone was going to school on borrowed money. It was expected.

On the flip side, some of us feel gift guilt knowing what our parents sacrificed to pay for school. It’s compounded when we see our parents in a compromised financial situation because they prioritized us. In this case, the privilege of not having student loans feels more like guilt.

That guilt is agnostic to our level of success. Some out-earn our parents and feel obligated to care for them. Others feel like we’ve undershot our parents’ professional expectations after they paid for school.

If you have big feelings, wherever on that spectrum they may be, know they’re natural, and you’re in good company. Don’t let them become the sole driver, however, of how you choose to prepare your own kids.

Instead, my suggestion is to take a deliberate and balanced approach.

I’ll share my own experience of paying for college, because it strikes a balance between graciously providing for your kids while giving them skin in the game.

My parents paid for my first two years at the University of Pittsburgh where I studied finance from 2008 to 2011. The second half was funded with Stafford Loans that I repaid after starting my first big-girl finance job.

It took me less than four years to graduate. I cut it a semester short, which saved me at least $8,000 in student loans to pay back.

I hate to say it, but had my parents been footing the entire bill, I’m not sure I would have jammed my last three semesters full of 18 credits. They incentivized me to be decisive.

Despite having some loans to repay, never once have I had a critical thought around why my parents wouldn’t have paid my full tuition. (Perhaps it’s because I’m one of four. 👯♀️👯♀️)

What they did helped me out tremendously and set me on a trajectory for financial success. At the same time, I feel proud that I paid some of my way.

Let’s run the numbers, continuing with our earlier example, but for partial tuition.

Assumes 5% average rate of return.

Planning to pay for half or a quarter of tuition brings the required investment for each child to about $2,800 and $1,400 per year, respectively. Monthly, you’re looking at $230 and $115 per kid.

That just feels a lot more doable, and it’s no small potatoes. You providing your kids with $80,000 for school will be a game-changer for them.

Strategies to Save for Both

Whatever amount you decide to cover, you can use these strategies to accumulate money for college while continuing to prioritize your retirement. The earlier you start, the easier it’ll be.

529 Investment Accounts

If you don’t have one of these for each of your children, open one, like yesterday. A 529 savings plan is an account designed to pay for education expenses. (It’s called a “plan”, but it’s really just a type of account.)

This is the tax-smart way to cover tuition. Money invested in it grows tax-free, forever, as long as it’s used to pay for qualified education expenses.

My family lives in Pennsylvania, so we have the PA 529 Investment Plan for our daughter. I opened this account for her as soon as I got her social security card to maximize the time the money can grow.

Most state plans, like Pennsylvania’s, offer age-based portfolios that align investments to the amount of time your child has until they go to college. So, you don’t need to know sh*t about investing to be successful.

During early years, more of the age-based portfolio is in stocks. Then, as kids approach time for college, the portfolio will automatically invest in more stable investments, like bonds. That way, the account isn’t going up and down as much when you’re using the money.

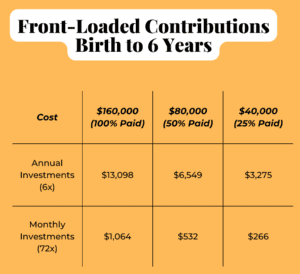

Front-loading Contributions

This strategy entails going hard with your college savings contributions during the first few years of your child’s life. Pulling it off requires adequate cash flow during these early years and even temporarily diverting some focus from your retirement investments.

Here’s what the numbers would look like to make all contributions from birth to six years.

Assumes 5% average rate of return.

By front-loading contributions following the example above, you reduce the cumulative amount you need to contribute meaningfully.

- Full tuition savings: $23,000

- Half tuition savings: $11,000

- Quarter tuition savings: $6,000

And what to do with this extra cash flow? I strongly recommend you plow it right back into your retirement, especially if you diverted any focus from there.

You have a little more wiggle room with retirement, since your investment time horizon easily could be like 50 years, compared to 18 until college. Know that there is a trade-off by following this strategy, though. You may end with less money for retirement, all things equal.

Simplify Gifting to a 529

Many 529 programs make it easy to gift money directly into the account. Pennsylvania’s does this by providing each kid with a unique gift code that you can share with friends and family. Anyone who has the code can send money directly to the account.

I shamelessly and ruthlessly share this code every chance I get. For example, it was prominently displayed on the invites for my daughter’s first birthday party. (Made a hard push for fewer gifts. Developing an eye twitch every time a V-tech toy goes off.)

My daughter has accumulated thousands of dollars purely from the generosity of friends and family members. Even if my husband and I were in a situation that we couldn’t contribute, they’ve already moved the needle for us. 🥹

Communicate the Game Plan

Whatever your strategy looks like, bring your kids in on the plan before college starts.

The sooner that they’re brought into this conversation about money, the sooner they can start thinking through the situation critically like a financially literate adult.

The last thing you want when making a huge decision, with tens of thousands of dollars at stake, is a big surprise.

I’ll end on a philosophical note about motherhood and money.

I try to live in a way that I’d be happy to have my daughter emulate. I’m a living example for her. That means not always putting myself last, including with money.

Living in a perpetual state of sacrifice would send a message to her that she should do the same for her own kids some day. Envisioning a world where she always forgoes enjoyment for the benefit of her own kids breaks my heart.

The decision to prioritize your retirement isn’t just the objective, emotionless viewpoint of a financial planner. For me, it sends the right parenting message.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.