This blog post will provide you with:

-

Spending benchmarks for a family of three

-

Actionable steps to make and stick to your own budget

-

Why you won’t get rich from budgeting alone

If you’re hoping I’ll regale you with my homemade acai bowl recipe to save on dining out, turn back now.

New budget who dis?

It’s been a minute since I put our 2022 budget out into the universe. Admittedly, it’s also been a minute since I checked in on it.

A lot has changed since the beginning of the year. I resigned from my job and am now staying home with my daughter while writing. This come-to-Jesus budgeting moment is brought to you by our transition to subsisting off a one income.

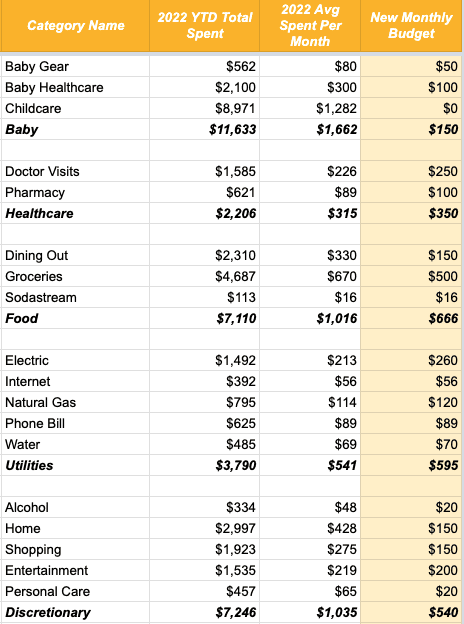

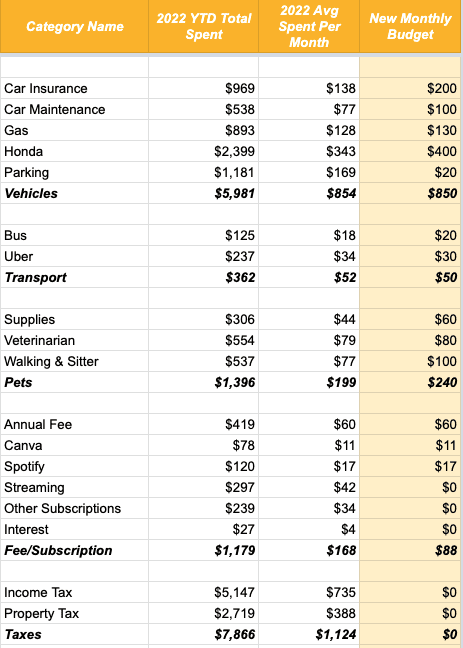

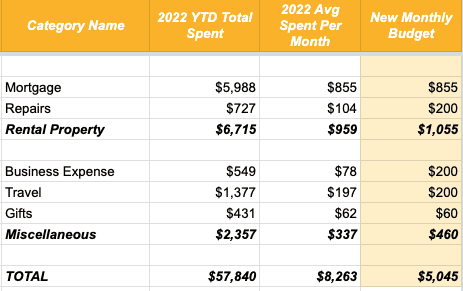

As a family of three, living in Pittsburgh, PA, here are our annual spending stats:

- 2021 actual spending: $64,000

- 2022 original budget (both working full-time): $85,000

- 2022 year-to-date spending: $58,000

- 2022 refined budget (single-income family): $60,000

In 2022, we’ve already spent about $58,000 as of the end of July. While that number is comprehensive and does include a rather painful tax bill from 2021, it’s still over-budget compared to our original budget of $85,000.

$60,000 is the new assignment, which equates to ~$5,000 a month.

That number includes all expenses and liability payments that we’ve committed to, like an investment property mortgage and a car payment for a 2020 Honda CR-V (that I’m trying to convince my husband to sell – stay tuned 👀).

My money management philosophy is to cash-flow everything with income as it comes in without touching our investments. Further, we plan to continue investing any excess as much as possible.

To make sure we stick to this budget, I’m implementing a weekly process to review our transactions and track progress. Godspeed.

What’s changing? Outsourcing & convenience spending return to earth.🌎

From the time I returned to work from maternity leave until I left my job, my husband and I were slapping a bandaid on a chronic lack of time.

We never cured it, just perpetuated what felt like a vicious cycle of earning money, then spending that money to try and fix a shortage of time.

Sidebar: Because we were on an absolutely prolific takeout food bender during this time, I’ll aptly refer to that period as the takeout times.

If you’re a working parent, you’re probably shaking your head in solidarity. After all, isn’t the cycle I just described the reality of modern parenting while working?

I’ve reflected quite a bit on how our purchasing decisions made me feel during the takeout times. It’s not the amount we were spending that troubled me – I’d categorize us as pretty frugal.

I also recall from the final, lingering econ 101 morsel left in my brain that at my wage, it made financial sense to continue earning, then outsourcing tasks that can be completed at a lower rate.

Instead, our spending problem was one of misalignment. It felt like I was paying others to do too many things that I wanted to do myself, like spending quality time with my daughter more than two days a week.

So, we pushed reset. ⏮

Childcare is coming in-house with me, which will slash a cool $21,000 a year, plus $300 a month in commuting costs. Of course, we’re addressing the usual sneaky budget suspects, like eating out less, ending the takeout times era.

In case I’ve given anyone mommy guilt for not making the same choice as me (or not having the same privilege to do so), let me clarify where I stand. Research consistently shows that having a working mom benefits children later in life.

In a nutshell, the study found that daughters of working moms are likely to go on to earn more and hold more senior positions.

Sons of working moms, on the flip side, are more likely to share the burden of household work equally with their partners as adults.

The desired end state I’d like to reach for my family is one that strikes a better balance between work and family. I envision my daughter eventually attending day care again, at least part time, while I work from home.

Actionable Steps to Create Your Budget

Disclaimer: I am not a budgeting enthusiast. I probably am, however, much closer to your average person who literally can’t even when it comes to reviewing transactions. So, you might just find this process manageable, too.

1) Quantify

Tally up what you’ve spent over the past several months, per month. I’d suggest looking back at least 3 months, but closer to 12 months is ideal. As long as the time period you’re using is a fair representation of your spending habits, use it.

Download transactions from your credit cards and checking accounts or use a budgeting app that aggregates them for you. I do this in a spreadsheet.

2) Categorize

Categorize spending into logical groups. To start, groupings suggested by your credit card data or budgeting app can help. You can also use mine above.

The end goal of this step is that you see exactly where your money is going. Determining what outflows are fixed versus variable will give you a clearer picture into your spending habits. Knowing your fixed expenses is important should the proverbial sh*t ever hit the fan.

3) Set Budgets

Using what you’ve learned in the first two steps, set your new budgets. Here’s where I deviate from conventional budgeting advice and show my cards that I’m not a purist. 😇

Get clear on what your objective is before you set your new budgets.

Objective #1: cutting back/changing behavior. If you’re reining in your spending, set your budgets at the category level, like I did above. Granularity is your friend if you want to understand your spending and monitor it closely on an ongoing basis.

Objective #2: awareness/preventing lifestyle creep. If you’re budgeting because you’re curious how much you spend or want to prevent lifestyle inflation, you might not need to go full forensic accountant.

I’d only suggest this lite method if you routinely have excess money to invest after covering your expenses each month and are content with your lifestyle.

Set your monthly budget at a total-spend level that enables you to continue hitting your investing goals. If you’re below your total budget after reviewing your credit card and checking spending each month, say no more, fam.

Could you leave money on the table by not going deeper? Yup. I can say with near certainty that I’ve missed out on savings in the past this way.

My philosophy is that time is money, and spending time focusing on something that doesn’t matter is a waste. Because money is fungible, a dollar spent on takeout versus one spent on groceries is still a dollar.💸

But, for now, my objective is to change our behavior. To do that, I’ll monitor our spending by implementing a budgeting app that automates expense tracking in real time. I’ll report back!

You won’t get rich from budgeting alone. It’s only one piece of the puzzle.

Budgeting is just one piece of the puzzle, a means to an end.🧩

The end? Having enough money to invest each month after covering your expenses. Regularly investing that excess is how you build wealth, little by little, for your family over time.

This leap from day-to-day management of household spending ➡️ investing for long-term goals is where women, especially married millennial women, often disengage, passing the baton to their partners.

To put numbers to it, a study conducted by UBS found that 88% of millennial women planned to share equally in long-term financial decision-making (i.e., investing) with spouses prior to marriage. That stat feels right…but here’s where we go off the rails.

Only 15% of millennial women actually end up sharing equally in those decisions after marriage.🤔 For a generation of women that’s consumed this many Spice Girl lollipops, how could this be?

In short, the survey showed that women doubt their financial knowledge and defer to husbands, who seem to know more about investing.

Husbands are out there doing their best with this responsibility; I’m not trying to discredit anyone. I’m here to remind you, though, that the average man doesn’t know any more than you, even about money.

Don’t mistake confidence for competence, and don’t let something that seems complicated on the surface intimidate you. Once you dig in, you’ll be shocked how easy investing actually is.

After building your budget, take the next step to get involved with your family’s investments. Great things happen when women, and their families, have more money.

I’ll end with a cautionary, yet (hopefully) motivating, tale from my financial planner soapbox.

I led a team of about a dozen financial planners for the past several years. Every year, they built thousands of financial plans for clients who, on average, were in their late 50s or early 60s.

Across the thousands of client financial situations that I’ve seen, a consistent theme is that the vast majority of people have absolutely no clue how much money they spend.

To give you some numbers, here’s an example of a pretty routine case that would come across our desk. Folks are in their late 50s, approaching retirement. They have about $700,000 to their names that they want to invest.

Over the past 20 years of their careers, together, they’ve brought home an average of $150,000 a year. They explain that they believe they spend about $35,000 a year.

You’ve probably already done the quick maths to know that something’s awry.

- $150,000 earnings – $35,000 expenses = $115,000 excess * 20 years = $2,300,000 accumulated

- $2,300,000 – $700,000 = $1,600,000 missing

If their expense number is correct, they should really have somewhere in the range of $2.3 million, not $700,000.

Further, this isn’t even considering any investment growth they could have earned. The $1.6 million that they’re “missing” was either spent or eaten by inflation because it sat in cash.

The tragic part? This is totally preventable with awareness and small changes.

They waited so long to create a budget, review their finances, and put a plan in place. Had they done it in their 20s or 30s, they could have thousands, if not millions, more.

Considering you’ve reached the end of a 2,000-word blog post about budgeting, you’re at the right place. If you’re in your 20s, 30s, and even 40s, you can drastically change how much wealth your family accumulates by creating a budget, sticking to it, and investing the excess.

It’s all possible with a game plan in place, even if you’re a single-income family for a while.😊

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.