This article explains how the PA 529 Guaranteed Savings Plan works. Read it to determine if this is the right type of college savings account for your family.

What is the PA 529 Guaranteed Savings Plan? The broad strokes.

Pennsylvania offers two types of 529 college savings plans: the PA 529 Guaranteed Savings Plan (GSP) and the PA 529 Investment Savings Plan (ISP). In both types of accounts, the tax benefits are identical.

The money you contribute grows tax-deferred and can be used tax-free for qualified education expenses. Plus, you’re able to claim a PA 529 plan tax deduction on Pennsylvania state income taxes for contributions up to $17,000 per year, per individual (in 2023).

Where the guaranteed and investment plans differ is risk and reward.

The PA 529 GSP is your lower-risk and lower-reward option. Any money you put into it will grow by the tuition inflation rate of Pennsylvania colleges each year. It’s this straightforward: if the average cost of college tuition rises by 2% in 2024, then your account balance will grow by about 2%. (Who cares how the stock market does? Not you!)

You’re paying for future college expenses at today’s prices with the PA 529 GSP. In fact, most other states call this type of college savings account a “pre-paid tuition plan.” Pre-paid tuition plan or guaranteed savings plan…they’re essentially the same thing.

In a nutshell, I’d think of the PA 529 GSP as less of an investment account and more of a way to pre-pay for future college expenses with some nice tax perks.

How much can I earn with the PA 529 Guaranteed Savings Plan?

You’ll earn the rate of college tuition inflation specifically of Pennsylvania colleges, net of expenses of the program. As of 2023, if you opt for electronic delivery of statements, the program fee is 0.30% of assets in your account. This caps out at a max of $250 per year. It’s competitive.

I can’t predict what the college tuition inflation rate will be in the future, but we can look at the past to make a reasonable guess at what’s to come. From 2010 to 2020, the national average tuition inflation rate was about 3% per year. If you were an investor in a pre-paid tuition plan during that time, you would have averaged roughly 3% per year, less the 0.30% advisory fee.

A 2.7% annual return isn’t much to write home about – nor is it guaranteed! – but you can expect your account value to be relatively stable. Your balance won’t fluctuate up and down like it would while invested in the stock and bond markets via the PA 529 ISP.

Related Post: PA 529 Plan Investment Strategies

How does the PA 529 GSP calculate the tuition inflation rate?

Pennsylvania determines account growth rates by calculating the actual tuition inflation experienced by in-state colleges. To do this, the state divides schools into “Tuition Levels,” which are groupings based on type of school. For instance, there’s a Tuition Level for Ivy League schools and then a separate one for Community Colleges.

Bucketing by type of school helps both you and the state predict how much money should be in your account come enrollment time.

From 2022 to 2023, here was the tuition growth experienced by PA colleges.

These are the credit rates most recently applied as shown in Pennsylvania’s Current Rate Card.

- Private Four-Year Colleges: 2.16%

- Ivy League Colleges: 3.13%

- State-Related University Average: 3.06%

- Community Colleges: 3.30%

- State System of Higher Education: 0.00%

If you’re always scheming like me, you might be wondering if picking the Community College Tuition Level because it had the highest rate could be advantageous. Bummer – it doesn’t really work like that.

The PA 529 plan will retroactively apply the tuition growth rate of the type of school the beneficiary actually attends to your account balance.

On the flip side, the good news is if you were banking on your kid going to a State School (lower rate), and then they stun you with an Ivy League (higher rate) acceptance letter, you’re covered. In summary, there’s no way to game the system, but simultaneously, you don’t need to stress about picking the wrong type of school either.

What exactly is “guaranteed” by the PA 529 Guaranteed Savings Plan?

Do you want the good or the bad news first?

Not to sound alarmist, but the truth is not much is actually guaranteed. This is made pretty clear by the PA 529 Disclosure Statement. (Yes, I’m out here reading this stuff. No, I am not well.)

The PA 529 Guaranteed Savings Plan functions somewhat like a pension. The state pools all account holder contributions together and invests it in a mixture of stocks and bonds. The goal is to earn a return that matches or beats the college tuition inflation rate so the state can make good on its future commitments to account holders.

It’s this pool of money – and this pool of money alone – that’s backing the commitments of the plan. Here’s a note in the fine print of the PA 529 GSP Disclosure Statement saying as much:

The PA 529 GSP Disclosure Statement. Section G. The Guarantee of the PA 529 GSP and GSP Fund.

Truthfully, I’m not sure what would happen if the state wouldn’t have enough assets to payout what’s promised. In no uncertain terms, the Commonwealth says it will not be stepping in as a backstop.

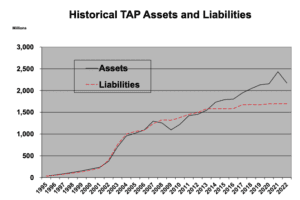

The good news is you probably don’t need to worry about this. The investment fund of the PA 529 GSP is in a strong position to make good on its future commitments. As of June 30, 2022, the GSP fund had more than adequate assets to cover future liabilities owed.

The distance between the blue and red line below is promising. 💪

Comparing the PA 529 GSP to other states

If you’re a PA resident, you’re in the minority of Americans who can access a pre-paid or guaranteed savings plan. This type of college savings account has an in-state residency requirement.

All 50 states sponsor at least one version of 529 plan, but most offer the investment version and not the guaranteed version. Guaranteed savings plans are actually a bit of a lost art.

Remember that with investment plans, it’s the account holder (you and me) who bears the investment risk. Under a guaranteed savings plan, it’s the state who holds the risk.

Because interest rates were so low for so long, this “risk ownership” led many states to do away with their guaranteed savings plans altogether. Because bonds yielded virtually nothing, it was challenging for pooled investment funds to earn a 3-4% return to match tuition inflation without taking on an unnerving amount of investment risk. To many states, the risk wasn’t worth it to continue offering a pre-paid plan.

At one time, there were up to 22 states that offered guaranteed plans. Today there are just nine, with the PA 529 GSP being one of them. Other states that still offer a pre-paid plan are Florida, Maryland, Massachusetts, Michigan, Mississippi, Nevada, Texas, and Washington.

Mark your calendars for August 31st. ✏️

There are benefits to contributing to your PA 529 GSP account before August 31st of each year. Because the state applies tuition inflation on September 1st, contributions made by August 31st receive credit even if they’ve been in the account for just a day.

You’ll still need to keep the money in your account for at least a year before you can use it for qualified education expenses, but this is still an effective strategy for maximizing growth.

Conclusion

If you’re a PA resident and in the market for a more conservative option to save for college, the PA 529 Guaranteed Savings Plan is a solid choice. This is likely you if the stock market makes you queasy or if your child is in the last ~5 years before they’ll use the money.

For the safety that the PA 529 plan provides, you are making a tradeoff. Over long time horizons (i.e., 10 years or more), the college tuition inflation rate has been lower than the average return of a stock and bond portfolio. In other words, it’s probable a PA 529 GSP account will underperform a PA 529 ISP account over time.

If you have a very young child, know that your time horizon warrants taking some risk, as long as you can stomach it. Think hard about the type of 529 account you choose. The more you earn in your account (and can use tax-free!), the less you’ll need to stash away.

Related Post: Pennsylvania 529 Plan Review

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.