How are other families investing in the PA 529 Plan? This article outlines their behavior, including two intriguing strategies & one avoidable pitfall.

It’s like people-watching but with money.

When conducting research for a deep-dive I wrote on the PA 529 Plan, I noticed something…odd. Within the PA 529 Investment Plan, there are a lot of pretty aggressive investors. Putting the Commencement Portfolio aside, families appear to be swinging for the fences.

(The Commencement Portfolio is like a conservative parking lot for money remaining in Target Enrollment Portfolios four years after the beneficiary’s enrollment year.)

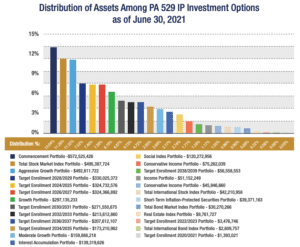

Source: PA 529 Plan Annual Report 2021

To put a number to it, 50% of all assets in the PA 529 Individual Enrollment Portfolios are in the Total Stock Market Index, Aggressive Growth Portfolio, or the Growth Portfolio.

Those investment options are positioned mostly in equities. Pretty aggressive!

| PA 529 Investment Option | Stocks | Bonds |

| Stock Market Index | 100% | 0% |

| Aggressive Growth | 100% | 0% |

| Growth | 75% | 25% |

This left me scratching my head, because the time horizon to save for college is 18 years at its longest. For perspective on how short this really is, consider that your average American has a ~40-year timespan to invest for retirement.

Within those 40 years, conventional advice suggests that younger investors – those in our 20s, 30s, and perhaps early 40s – put most, if not all, of our investments into the global stock market. Once we hit our 40s and 50s, about T-18 years out from retirement, professionals would generally start reducing risk by mixing more bonds into a portfolio.

So, wut in tarnation are these families doing loading up on risk with the same timeframe, if not shorter? At most, I’d expect the average account to go hard in stocks when the beneficiary is very young – let’s say from birth until age five – then start dialing back.

Based on how money is distributed among the PA 529 Plan investment options, that’s not what’s going on.

Here are three interesting investor behaviors on display in the PA 529 Plan. There are two strategies that you may want to consider in your own family’s investing playbook and one common pitfall to avoid.

(1) Families are using the PA 529 Guaranteed Savings Plan as a fixed income replacement.

Pennsylvania offers two types of 529 Plan. If you or the beneficiary is a PA resident, you can use both accounts at the same time.

- PA 529 Investment Plan (ISP) – Higher-risk option. Use it to invest for future college expenses. This type of 529 plan is more appropriate for families that are comfortable taking investment risk. As with any other investments, nothing is guaranteed, but you do have a shot at higher returns.

- PA 529 Guaranteed Savings Plan (GSP) – Lower-risk option. Use it to prepay future college expenses at today’s tuition rates. This type of 529 plan guarantees that money in the account grows by the college tuition inflation rate every year. We don’t know what that rate will be, but we do know that this account will keep pace with tuition inflation and won’t fluctuate with the market.

We’re seeing families open up two✌️ accounts for the same beneficiary – one under the PA 529 ISP & one under the PA 529 GSP – and use them to segregate their stock and bond exposure.

The ISP is the bucket where families are putting all of their equity exposure. The GSP is the bucket for all “bond” exposure. Depending on your risk tolerance, this could make a ton of sense.

ISP (Equity Bucket) + GSP (Bond Bucket) = Total 529 Portfolio

The primary benefits that bonds should provide are stability and diversification. While the GSP isn’t actually a bond, it can step in to serve both of these purposes.

Plus, the GSP comes with an advantage that bonds don’t have: the guarantee to grow with college tuition inflation. Money invested in the fixed income market comes with no such promise.

Bonds are more stable that stocks, but they’re still investments that can lose value, with 2022 being an acute example of that. Even diversified, high-quality bond funds slumped double digits this year because of the rise in interest rates. 😬 As such, this recent history has made a compelling case for using the GSP as an alternative to investing in bonds in an ISP account.

When interest rates are very low, like they were for the past decade, the reward of investing in bonds (in the ISP) might not be worth the risk when the GSP is an available option.

Investing in fixed income in a low-rate environment is like picking up pennies in front of a steam roller. You’re being paid low yields to stand on the precipice of a steep drop in prices if rates go up.

As with all things finance, there’s a tradeoff. By plugging the GSP in as your bond proxy, there’s always the potential to miss out higher returns from the bond market. There’s no way around the law of investing (and more broadly, in life) that the amount of risk you take is linked to how much you could earn.

🔮 As of December 2022, with interest rates sitting at more “normal” levels, the potential opportunity cost of missing out on more attractive returns with bonds is higher than it has been in a decade. Moreover, it’s impossible to predict what the future college tuition inflation rate will be.

These factors mean this isn’t a clear-cut decision, but there’s one thing I can tell you for certain. If introducing diversification and stability to your portfolio and keeping pace with college tuition growth are important to you, the PA 529 GSP can accomplish both.

(2) Families are using 529 plans to create generational wealth.

529 Plans are *primo* tools for creating generational wealth. Within them, families can amass small fortunes that pass to heirs tax-free as long as the money is eventually used for qualified education expenses. And, they’re virtually frictionless to transfer to new beneficiaries in the same family.

In the PA 529 Plan, money can be added to accounts until they cumulatively cross $511,758 per beneficiary. It’s okay if the account grows beyond that threshold – you just can’t contribute more until it falls below again.

Pennsylvania happens to have one of the highest 529 asset caps in the country that wealthy families readily exploit.

So, how would a (soon-to-be) wealthy family go about this? Each year, you (or perhaps a richer relative) could contribute up to $16,000 for individual single-filers or $32,000 for married, joint-filers into a 529 account. These amounts are per beneficiary, so if you have two kids, you can put that amount into each of their accounts.

This removes money from a wealthy family member’s estate during their lifetime, while the account owner maintains control of the assets.

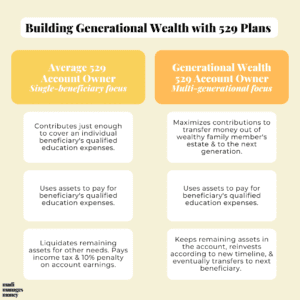

The goal is to fill the 529 account up to the max per beneficiary, even if it’s more than that one person needs for school. Then, come college time, the account owner disperses the desired amount like you’d guess, which brings us to the juncture where wealth-building paths diverge.

Families that use 529 plans to build generational wealth do three things differently. They purposely overfund accounts, keep them open after the original beneficiary’s needs have been met, and then reinvest any excess money aggressively to prepare for the next beneficiaries.

If you’re in this for the people-watching, you’ll notice this is partly why there are so many aggressive investors in the PA 529 Plan. The biggest accounts belong to wealthy families who are able to play the long game, reinvesting money in equities for future beneficiaries.

Here are what these two paths would look like for accounts that had $10,000 remaining in them. Let’s assume that $10,000 is made up of $5,000 in contributions and $5,000 in earnings.

- Withdraw remainder for other immediate needs – Income tax plus a 10% penalty will be owed on the earnings portion. Assuming the 22% income tax bracket, this would leave you with a net ~$8,400 today.

- Keep remainder in the account & reinvest – No tax consequences. 😍 Assuming the $10,000 grows at 6% annually, the account could be worth ~$57,000 in 30 years. This is tax-free and without contributing another dime.

The numbers decisively tell us why this is smart tax-planning strategy, but I also want to acknowledge that it’s a very privileged one, too.

For most of us, the primary goal of funding a 529 account is to pay for college for someone we love. Average families are under tight financial constraints with plenty of needs ranking above your unborn grandchild’s college tuition.

Regardless the account size, feel proud of what you’re able to accumulate, because even smaller amounts create BIG swings in a young adult’s finances.

If, however, you find yourself deciding how to handle an extra few thousand dollars in a 529 account, you now have this in your back pocket. Normal people should and can take full advantage of strategies like this!

Related: What if I Invest Too Much in a 529 Plan?

(3) The pitfall: Families are chasing returns.

If investor behavior had a good, bad, and ugly, this would be the ugly part. The final reason why there are so many aggressive investors in the PA 529 Plan is that they’re making investment choices based on past performance.

The three Individual Enrollment Portfolios with the most money in them aren’t just three of the riskiest options; they’re also the ones with the highest Since Inception returns.

From experienced to novice investors, we’re all guilty of it at some point. Maybe it was starting a full-time job, faced with picking investments for our 401(k). Left to fend for ourselves, we reviewed a menu of investment options, hastily located the few with the best returns, and voila – there’s our portfolio!

The most ubiquitous disclaimer in investing bears shouting from the rooftops because it’s true. Past performance doesn’t predict future returns, which is the downfall of this methodology.

For example, just because U.S. large cap stocks returned an average of ~14% per year over the past decade, that doesn’t mean they’ll produce that for the next.

I’m not suggesting that you pick investments without considering performance at all. (This isn’t a blind audition on The Voice.)

It’s just that what you learn from past performance has less to do with returns to expect in the future and more to do with the amount of volatility you may need to endure.

Risk and return are inextricably linked. If you pick an investment that has historically been better-performing, gird your loins, because you’ll need to be willing to accept the risk that comes with it.

Applying this to your own family’s finances.

There’s nothing inherently wrong with investing aggressively. In fact, I’m a contributing statistic (albeit small) to the aggressive investors in the PA 529 Investment Plan. This is the right choice for my family because my daughter has a long time horizon, and we’re comfortable taking investment risk.

To apply the behaviors in this article to your advantage, first assess how much risk your family can take. This includes both your comfort with investment risk and if you’ll be in the financial position (i.e. liquid enough) to leave money invested for the long haul. 🤠

- If you self-manage a PA 529 Plan account and are ready to downshift overall risk, you could do so by investing directly in the PA 529 GSP instead of in a bond index fund within the PA 529 ISP.

- Overfunding a 529 account is a tactic to create generational wealth. If faced with the decision to liquidate a 529 account or not, consider keeping it open and reinvesting aggressively for future generations. Small amounts compound into large ones over long periods.

- Picking investments based on the expectation that historical performance continues into the future is a fool’s errand. Consider the level of risk that’s right for you first.

Thanks for reading! Keep playing the long game. 🤓

Related: 8 Key Financial Steps for Baby’s 1st Year

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.