Finally, a Black Friday decision your financial planner can get down with. Apply for the Madi Manages Money Course + Consult Service here.

If you’ve got that lingering financial conundrum that you can’t scratch off your to-do list alone but feel like you aren’t quite ready to hire a full-time financial planner just yet, I’ve got your answer.

From Black Friday to Cyber Monday, applications are open for a focused financial planning consultation service that comes with unlimited access to my digital course, the Family Financial Planning Masterclass.

I’m taking up to 10 clients to trial this “lighter” service, priced at $497. Here are the details.

What does the Course + Consult include?

- 90 minutes for consultation (60 up front, 30 for follow up)

- Access to the Family Financial Planning Masterclass, a self-paced digital course that teaches mothers how to invest confidently

- Written recommendations & answers to your specific questions

The 90 minutes of consultation can be split between an initial 60-minute consultation and a 30-minute follow-up appointment. After we’ve had our initial call and you’re officially signed on as a client, I’ll provide you with prompt access to the Family Financial Planning Masterclass.

I’ll deliver written recommendations and answers within two weeks of our initial consultation. At that time, you’ll have the opportunity to schedule our second call for follow-up questions or help implementing your recommendations.

About the Family Financial Planning Masterclass

The Family Financial Planning Masterclass is for mothers (or expectant mothers) between the ages of 25 to 45. Dads are welcome, too, of course, but you’re riding in the back seat.

If you want to take your family’s finances to the next level without paying 1% of your assets annually to an advisor, this course is for you. You’ll learn the money moves it takes to secure your family’s financial future.

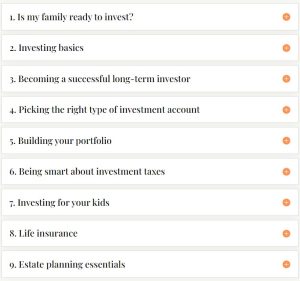

It’s self-paced, covering nine core modules and is designed to be completed in ten hours or less. You’re a great fit if you’re a self-starter who appreciates the profound impact your financial literacy has on your family’s well-being.

The course takes roughly 10 hours to complete. You’ll have lifetime access to it (or as long as Madi Manages Money is in existence), but it would be *optimal* to work through it during the two weeks while I’m writing your recommendations. That gives you dedicated time to ask questions at your final consult.

What are examples of questions to ask?

There isn’t a predefined menu of questions to address, but I can tell you about some ways I’ve helped clients get “unstuck” in the past. These would all be a good fit for this service.

-

- Help with rolling over an old employer retirement account, plus selecting an investment in your new account.

- Reviewing your employer retirement plan contribution and investment strategy. (Am I investing enough? Am I using the right investments?)

- Analyze the existing investments in your accounts and recommend a portfolio that’s right for you.

- Establish a 529 account and college savings strategy for your children.

- A review of the life insurance coverage you have (or are looking to put in place) for your family.

- Help doing a backdoor Roth IRA contribution.

Why the Application Process?

I want to make sure I can adequately meet your needs in this focused format before we get in deep. Also, I want applicants to demonstrate that they’re serious about moving forward since I am only taking a few folks.

This isn’t a comprehensive financial plan, and I want that expectation to be clear from the jump. If your needs are more complex than what this service provides, I’ll tell you so, but I won’t try to upsell you into other services. Promise.

The application gives us a jump start on our initial consultation. It asks for the top 1-3 financial questions you’d like to address on our call, so we can hit the ground running. If there’s additional info I’d need to ensure our consultation is valuable (like investment statements), I’ll give you a heads up to gather them for our call.

I’ll respond to all applications by Friday, December 1st.

Here’s to trying new things!

I’m super excited to try this out with some of you! The goal is to meet you where you’re at, by providing high-quality advice at an accessible price point.

Apply for the Course + Consult service here.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.