If financial planners had a party trick, it would be the backdoor Roth IRA.

A backdoor Roth IRA isn’t a type of account. Instead, it’s a process for getting money into a Roth IRA if you earn above the income limits to contribute to one directly.

In this post, I’ll explain when it’s time to consider backdoor contributions. I’ll also give you the play-by-play of how to execute them and a common way you can wreck yourself if you don’t know what you’re doing. 😬 (Don’t worry; I’m being dramatic.)

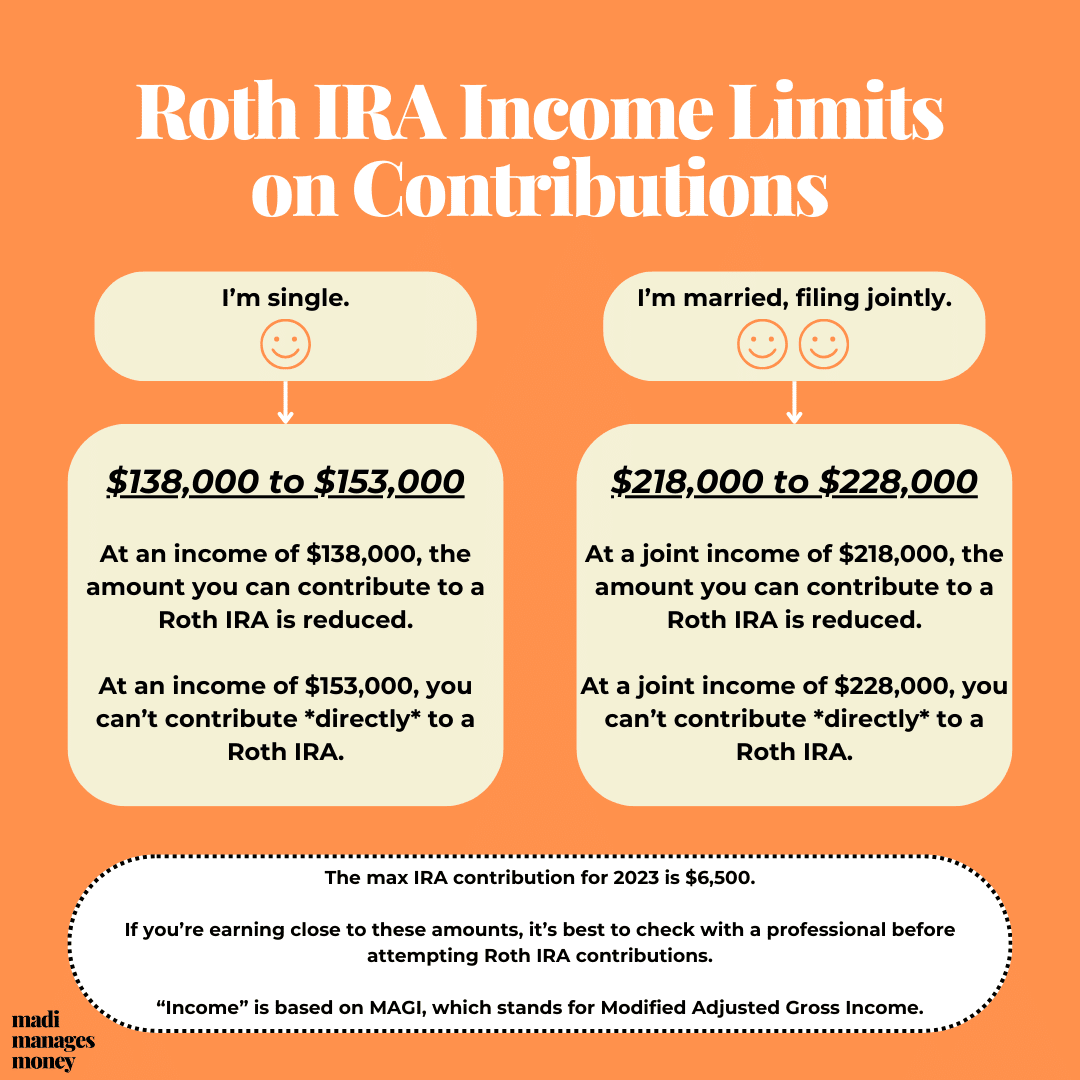

Roth IRA Income Limits

Once your earnings reach the following levels, you can no longer contribute *directly* to a Roth IRA. This is when the backdoor party starts.

Here’s a link to the IRS source.

You’ll notice these are ranges. Once your adjusted income reaches the lower bound of the limit, the amount you can directly contribute is reduced based on a formula. By the time your income reaches the upper bound, you’re precluded from contributing completely.

You can make backdoor Roth IRA contributions every year that you have earned income; it’s not a one-and-done thing.

The maximum you can contribute via the backdoor is the IRA limit, which is $6,500 in 2023.

How to Do a Backdoor Roth IRA: The Steps

A backdoor Roth IRA contribution goes like this.

- Make a nondeductible contribution to your Traditional IRA.

- Don’t invest the money in your Traditional IRA yet. Let it rest in cash.

- Promptly transfer the money from your Traditional IRA over to your Roth IRA.

- Invest your money once it lands in your Roth IRA.

Before you start, you’ll want to have a Traditional IRA and a Roth IRA opened up at the same company. Unless you’re a glutton for punishment, I’d keep these accounts in the same place. For instance, open both up at Fidelity, or open both up at Charles Schwab.

Because you’re putting money into your Traditional and then transferring it over to your Roth, I’ve heard some advisors refer to this process as a “two-step Roth.” It might seem convoluted at first glance, but it’s not so bad once you get a few under your belt.

The transfer part in step 3 is called a “Roth conversion.” This transfer step is the exact point that could trigger tax consequences, which we’ll get to next.

If you have money in Traditional IRAs, pump the breaks.

Before you make a beeline for the backdoor, let’s make sure you aren’t setting yourself up for any unintended tax consequences.

If executed as drawn up, backdoor Roth IRA contributions aren’t a taxable event because you’re making them with nondeductible contributions (i.e., money you’ve already paid taxes on, AKA post-tax money) to your Traditional IRA.

Now, if you have pre-tax money sitting in a Traditional IRA, this changes things. Your backdoor Roth IRA contribution will count as taxable income.

The amount of tax you could owe is proportional to the percentage of pre-tax assets to post-tax assets you have in all of your Traditional IRAs. This rule is aptly named the pro-rata rule.

For example, pretend you have $13,000 held in Traditional IRAs. You might have this split among several IRAs or all in one. It doesn’t matter – the IRS is like an all-seeing eye that includes it in the calculation.

The $13,000 came from an old Traditional 401(k) that you rolled over in your IRA, so none of it has ever been taxed before. Said differently, it’s pre-tax money.

Now, let’s say you went ahead and initiated the backdoor Roth IRA process by plopping $6,500 into your Traditional IRA. This brings the total value of all assets in your Traditional IRAs to $19,500. ($13,000 + $6,500 = $19,500)

Under the pro-rata rule, your backdoor Roth will be taxable. The taxable and non-taxable proportions are broken down like this.

- $6,500 / $19,500 = 33% of your backdoor Roth is non-taxable

- $13,000 / $19,500 = 67% of your backdoor Roth is taxable

That would make $4,333 of your $6,500 backdoor Roth IRA contribution taxable. ($6,500 * 67% = $4,333)

For most of us, the majority of our Traditional IRA assets will be pre-tax. This is especially true if you rolled over a Traditional 401(k) plan from an old employer into an IRA.

The bottom line: if you have money in Traditional IRAs, it’s likely your backdoor Roth IRA contribution will be a taxable event.

What if I open up an fresh, empty Traditional IRA?

By opening up a new Traditional IRA just for the purposes of making your backdoor contribution, you are not spared. The IRS wants you to take a bird’s eye view of all Traditional IRAs when determining your tax bill.

One exception to this is if you have an Inherited IRA (also known as a Beneficiary IRA).

If you open up an empty Traditional IRA to facilitate your backdoor contributions, in addition to the Inherited IRA you already own, you’ll be free and clear of the pro-rata rule. This is, of course, if these are your only Traditional IRA assets.

I have pre-tax assets in a Traditional IRA. What should I do?

A potential solution is rolling your Traditional IRA assets into your employer-sponsored retirement plan, like a 401(k) or a 403(b) plan at work. Workplace retirement plans have very similar tax rules and benefits to IRAs, so you’re effectively just consolidating accounts.

To determine if your workplace permits roll-ins, I’d take two steps.

First, locate a document called the Summary Plan Description for your retirement plan. Oftentimes, this is saved on your company’s intranet, or you can ask HR for it. The SPD will explain whether or not your retirement plan will accept your Traditional IRA.

Second, I’d call your company’s retirement plan administrator. When you log into your online retirement plan portal, there should be a number. They will give you instructions for how to complete a “direct rollover,” including exactly how the rollover check should be made out.

By rolling a Traditional IRA into your Traditional 401(k) (or equivalent type of workplace plan), you’re clearing the way for tax-free backdoor Roth IRA contributions. Only IRAs are in-scope for the pro-rata rule that causes the tax headaches above.

Backdoor Roth IRA contributions aren’t for everyone.

If you’re not sure if you can do a backdoor Roth IRA contribution or if your income’s even high enough to require one, it’s wise to consult with a professional. Backdoor contributions aren’t a blanket recommendation for high earners because of the tax bottlenecks above.

Since this is a maneuver you can do every year as a high earner, getting the greenlight and learning how to do it the right way will pay dividends for years to come (literally). You’ll save on taxes now and grow a tax-free bucket of money to use in retirement.

A financial planner (like me!) will look at your income level and where your assets are located before making a sound recommendation.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.