This blog post:

-

Puts the total cost of student loan relief into perspective

-

Quantifies how much of your taxes may go towards student loan relief

-

Takes a closer look at who’s paying for & receiving relief

Once President Biden announced the federal student loan forgiveness plan, Americans abruptly set out on two very different, but equally intense, Google search benders.

Those with federal student loans keyed frenzied phrases into phones like ‘how to know if you got a Pell Grant.’

The rest of us, myself included, wondered what this could do to our tax bills and what the implications are for the federal budget.

(Okay, the federal budget part is probably just me and your one cousin who carries a bug-out bag.)

My research was met with pages of politically-charged articles, from the left and right, making claims that were unnerving. After digging into a handful, I realized they didn’t stand up – they were sensationalist figures spun one way or another to play to my emotions.

This article will be the antithesis to that. I’ll do my best to walk you through the implications of student loan relief to your average American taxpayer by sticking to (and explaining) the numbers.

No debt is really forgiven – just shifted – making this a worthwhile topic to explore.

The Total Cost of Student Loan Forgiveness

A range of estimates quickly entered the fold for how much the proposed plan would cost the U.S. over the next 10 years. These, of course, come from a variety of sources that span the political spectrum.

Let’s run the gamut:

- The White House – $240 Billion

- National Taxpayer’s Union – $400 Billion*

- Committee for a Responsible Budget – $520 Billion

- Wharton Budget Model – $605 Billion

For the analysis summarized in this article, we’ll use the Wharton Budget Model’s comprehensive and comparatively conservative estimate. Given that this is an expense, I think it’s prudent to use the highest number.

Collectively, that puts us here as a country – staring down a $605 billion expense spread over the next 10 years. That’s a lot of money, right?

Perhaps not as much as you think.

Comparing Student Loan Relief to the Federal Budget

In 2021, the U.S. government’s actual spending was $6.8 trillion dollars. Federal revenues were $4.0 trillion, creating an annual deficit of about $2.8 trillion. Again, we’re talking trillions.

The estimated $605 billion figure from Wharton spread across 10 years equals $60.5 billion annually.

An expense of $60.5 billion represents about 0.9% of our country’s anticipated annual spending over the next decade.

Most of our spending goes toward Defense (13%), Social Security (21%), and major health programs (25%).

To put this on a more human scale, if you’re a person who spends $60,000 per year (which is about what I spend), this is the equivalent of making a $540 purchase.

So, is it free? Absolutely not. Is the amount smaller on a relative basis than the media would have made you initially fear? Probably.

Unless you believe that student loan relief is the straw that broke the camel’s back, I wouldn’t lose sleep over the impact this has on our country’s annual deficit or national debt.

Who’s Paying for Relief? American Taxpayers Pickup the Tab

Let’s take a closer look at federal revenues to see from where, and who, they’re actually coming.

If the past is prologue, we can expect about 83% of inflows to continue coming from individual income taxes and payroll taxes (AKA: $ from you and me, gf).

Spreading the $605 billion expected cost of student loan relief across 161 million taxpayers (which is the number the IRS expects in 2022) equates to a cost of about $3,750 per taxpayer.

A common headline I’ve encountered is, “Student loan program will cost taxpayers $2,500.” This comes from the National Taxpayer’s Union figure of $400 billion, divided by the number of taxpayers. Different cost estimate; identical calculation.

Calculating the estimated tax per person this way 👆 is majorly flawed for two key reasons:

- It’s taking an expense that’ll be incurred over a 10-year period and implying that it’ll be paid in one year, which sensationalizes the number.

- It assumes we’re all paying taxes equally, which is definitely not the case. We’ll put some numbers to this statement next.

The United States has a progressive tax code. The more 💰 you make, the more taxes you pay at higher rates. (I have to admit – who pays what in taxes was even more skewed than I realized.)

According to an analysis by the Tax Foundation, the top half of taxpayers paid 97% of all individual income taxes in 2019. The bottom half paid the remaining 3%. Taking it one step further, the top 1% paid 39% of all individual income taxes.

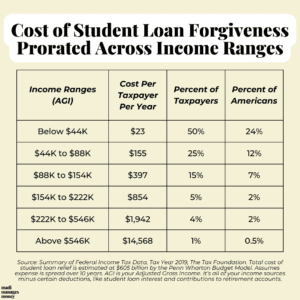

If the total expected cost of $605 billion is spread over 10 years and then prorated based on how much each income range pays in taxes, it looks like this:

This paints a very different picture than a $2,500 tax bill per person. On the low end, someone making less than $44,000 could expect $23 of their annual taxes to be used to cover relief.

When you consider how much of the tax burden the top portion of earners shoulders, you can see how student loan relief facilitates a transfer of hundreds of billions of dollars in wealth to people like you and me.

(Really going out on a limb here and anticipating that I don’t have much of a readership in the 1%.😉)

Now, this doesn’t mean that a tax bill will show up at your door for this amount. Instead, it means that if Americans continue to pay taxes according to the tax code that we have today, this is how much of your tax dollars would be required to cover the cost of student loan relief.

Looking at this distribution in isolation would lead you to believe that this is a pretty progressive policy decision. However, Who’s paying? and Who’s benefiting? tell different stories.

Let’s visit one last viewpoint before we reach our final conclusion, and that’s examining who the people actually are that are receiving relief.

Who’s Receiving Relief?

According to the Department of Education, 87% of debt cancellation benefits will go to borrowers earning less than $75,000. The remaining 13% would go to folks earning between $75,000 and $125,000 per year.

Surely you’ve heard (or even lived) this anecdote: the hardworking, blue collar electrician that made a prudent decision not to go to college, who’s now being asked to bailout the recent finance grad starting in investment banking.

Is there truth to that? To answer, we’ll lean on some fascinating data summarized by Nick Maggiulli on his blog, Of Dollars and Data.

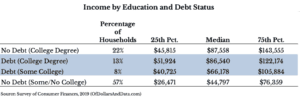

The table shows income by education and debt status for earners below $125,000. Maggiulli found that among college graduates, folks without student loans are doing better than those with student loans. Makes sense.

But to compare those with student loans to those without in a meaningful way, he separated folks with a college degree from those without. Herein lies the rub.

Americans that have college degrees and student loans are generally doing better than those with no college degree and no student loans. This provides some validation to our beginning anecdote.

From this angle, student loan relief looks more regressive. In some cases, recipients of relief will be relatively better off than those paying for it.

Conclusion

Student loan relief is a polarizing topic. In seriousness, it crossed my mind to call this post The Ultimate Holiday Argument Guide on Student Loan Relief.

So to keep things light, and in the spirit of preparing you to go toe-to-toe with your combative Uncle Dave sometime soon, here are the key points to keep in your back pocket:

- The total cost of student loan relief, even using a conservative (higher) estimate, amounts to just under 1% of our country’s annual spending.

- Be cognizant of how much money your audience makes before you launch into that monologue on the benefits of relief. The more one earns, the more income taxes they pay that could be used to cover relief.

- College graduates with student loans are generally doing better than peers without a college education and no loans. Yet, those with no degree and an income are asked to pay taxes, just the same.

I hope that if you started this article with an opinion, whatever it may be, you’re ending at a place that feels a little more centered.

Student loan relief is imperfect, unfair, and doesn’t solve the root issue, which is the inequitable cost of higher education. At its core, however, it’s a wealth transfer from America’s highest earners to student borrowers, who by and large, are people a lot like you and me.

I’m really looking forward to seeing how it benefits millennials, especially millennial women, over the next decade.

Sources:

- Nick Maggiulli’s Blog: Of Dollars & Data

- Estimates of Total Cost of Student Loan Relief

- 161 Million Tax Returns Expected in 2022

- 2019 IRS Income Tax Data

- Congressional Budget Office Data

*The National Taxpayer’s Union figure includes only the impact of debt cancellation. It doesn’t consider the lower 5% cap on income-driven repayment plans or the extension of the payment moratorium until December 2022.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.