This article explores:

-

If the stock market could fall to zero.

-

How the market has actually behaved over the past 150 years.

-

How likely you are to lose money, based on history.

94%

If you picked any day over the past 50 years to make a 10-year, buy & hold investment in the S&P 500 Index, there’s a 94% chance you would’ve come out on top.

This stat even considers market performance as of the end of September 2022, when the S&P was down about 25% year-to-date.

The problem? This near certainty of making money in the market as long-term investors is in direct contrast to the worrisome financial news that we’re inundated with daily.

This negativity leads to (understandable) anxiety about the stock market, that if left unchecked, can turn into temptation to sell investments at the absolute worst time — when the market is down. Or maybe even worse, it prevents us from ever starting investing.

This article will help you cope with anxiety about the stock market by zooming out from the daily news cycle. We’ll take a bigger-picture view of how stocks have actually behaved throughout history.

It’s probably a brighter story than you’ve been led to believe.

Could the stock market actually go to zero?

This question seems to climb to the top of most of our lists, especially after a good doomscroll.

I won’t bury the lede. Yes, it’s possible that the stock market could fall to zero, but the level of catastrophe required would be so extreme that you probably wouldn’t even care about money if it happened.

How extreme? you might ask. Here’s the part where I start sounding a little crazy, so buckle up. 😂

We’re talking about a Handmaid’s Tale-style regime change or apocalyptic event. One that would force dissolution of the U.S. government, or at least the entire financial system, as we know it.

It would be serious enough that the expected future earnings of the ~4,000 publicly traded companies in the U.S. would fall to zero, making their stocks worthless.

Surprisingly bad economic news followed by panic-selling will not be enough to do it. This is what generally causes major sell-offs.

Each time it happens, the market takes a good, long look at itself in the bathroom mirror while clinging to the sink and resumes its climb upward.

In markets with as many participants as the U.S. stock market, there will always be buyers for the right price, provided the financial system is intact.

So far in my career, something I’ve developed supreme confidence in is the greed of the American investor. There will always be people or institutions with deep pockets waiting in the wings to buy.

Lastly, I want to make a critical distinction between the stock market and individual stocks. Stocks can, and regularly do, go to zero. Use extreme caution when investing in them on an individual basis.

Despite devastating events, the stock market has recovered.

The chart below shows the performance of large, publicly-traded U.S. companies dating back to 1870. (Click to zoom.)

There’s some pretty scary stuff here. Even so, the stock market has found a way to continue its trend up and to the right. Why? Because the earnings of publicly-traded companies recover and then continue to grow.

This long-term uptrend paints a different picture than the daily news we’re accustomed to reading. You know the headlines.

The market plunges 200 points. Wall Street in panic as stocks crash.

As it turns out, the news doesn’t just seem more negative; it actually is. Research shows that emphasizing negativity is a legit phenomenon that’s observed even outside of financial news.

(This Freakonomics episode did an interesting overview of it.)

In a nutshell, journalists are exploiting a bias that draws us to unsettling news, which maximizes readership and profits. At the risk of sounding deterministic, we’re hardwired to pay closer attention to threats than good news.

They even have a saying: “If it bleeds, it leads.”

Coupling awareness of this bias with a 150-year market history 👆 should give you some confidence.

Suddenly, it becomes harder to make a case for why the financial fear-of-the-week is special compared to this laundry list of world-altering events, all from which the market has recovered.

Dear long-term investors, time & probability are on your side.

So far, we’ve established the general historical trend of the market and that it would take a lot for it to completely crash.

Depending on when you choose to make an investment, there’s still a decent chance you could lose money, right? That depends heavily on how long you’re willing to leave your money invested.

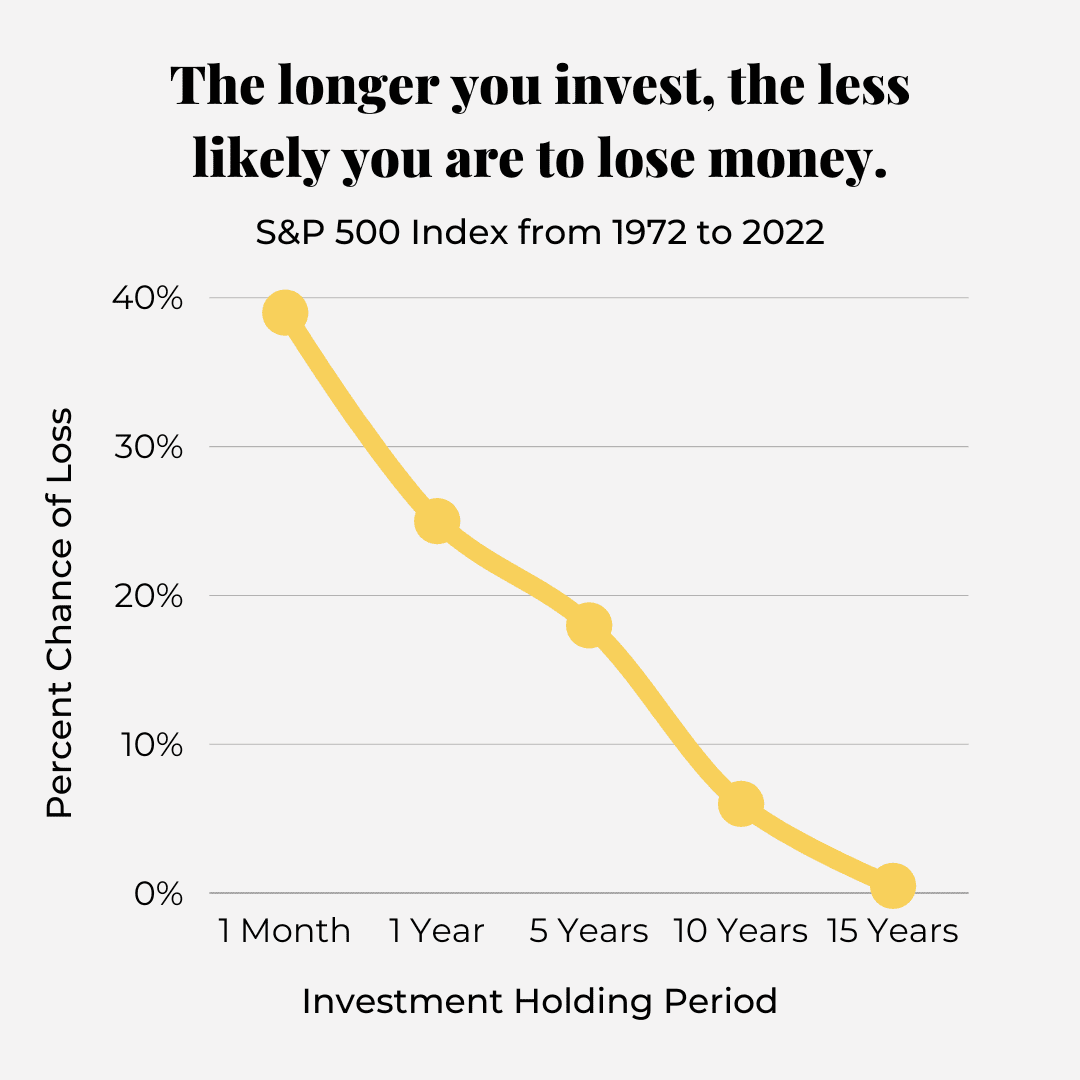

The chart below shows how often buy & hold investors of the S&P 500 Index would have lost money based on the amount of time they stayed in the market.

Source: Yahoo Finance, S&P Dow Jones Indices; not inflation-adjusted; price returns only

What did we find? The longer your investment time horizon, the less likely you are to lose money. In fact, when investors stayed in the market for 15 years or more, they were all but certain to come out on top.

Put bluntly, this chart is the reason that you shouldn’t give a sh*t about day-to-day stock market fluctuations if you’re a long-term investor. Most millennials 🙋♀️ who are putting money away for retirement fall squarely into that bucket.

Okay, Madi – just tell me what to do.

If you’re an investor in your 20s or 30s who’s saving for retirement, consider yourself initiated to the Long-Term Investors’ Club. The first rule of Long-Term Investors’ Club is that you do not react to market volatility.

Here’s how I set my systems up to remove that temptation from the equation:

- I set automatic, recurring investment instructions at regular intervals on my accounts. That means I don’t decide when to invest based on how the market’s doing.

- I avoid frequently checking account values when markets are down.

- I invest in diversified, low-cost index funds instead of picking individual stocks.

- I focus my energy on maximizing the amount of money I have left over each month to invest. I do this by growing my family’s income and planning our spending.

Then, if I still feel that wave of anxiety about the stock market come on, I steel myself with what we’ve learned:

- The U.S. stock market going to zero is highly improbable.

- It has trended up over the past 150-years and counting.

- Long-term, buy & hold investors have excellent chances of making money in the market.

Hey, you did it! Thanks for reading.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor. Past performance does not guarantee future results.