As a CFA, CFP, and mother, here’s how I invest money for my family of 3.

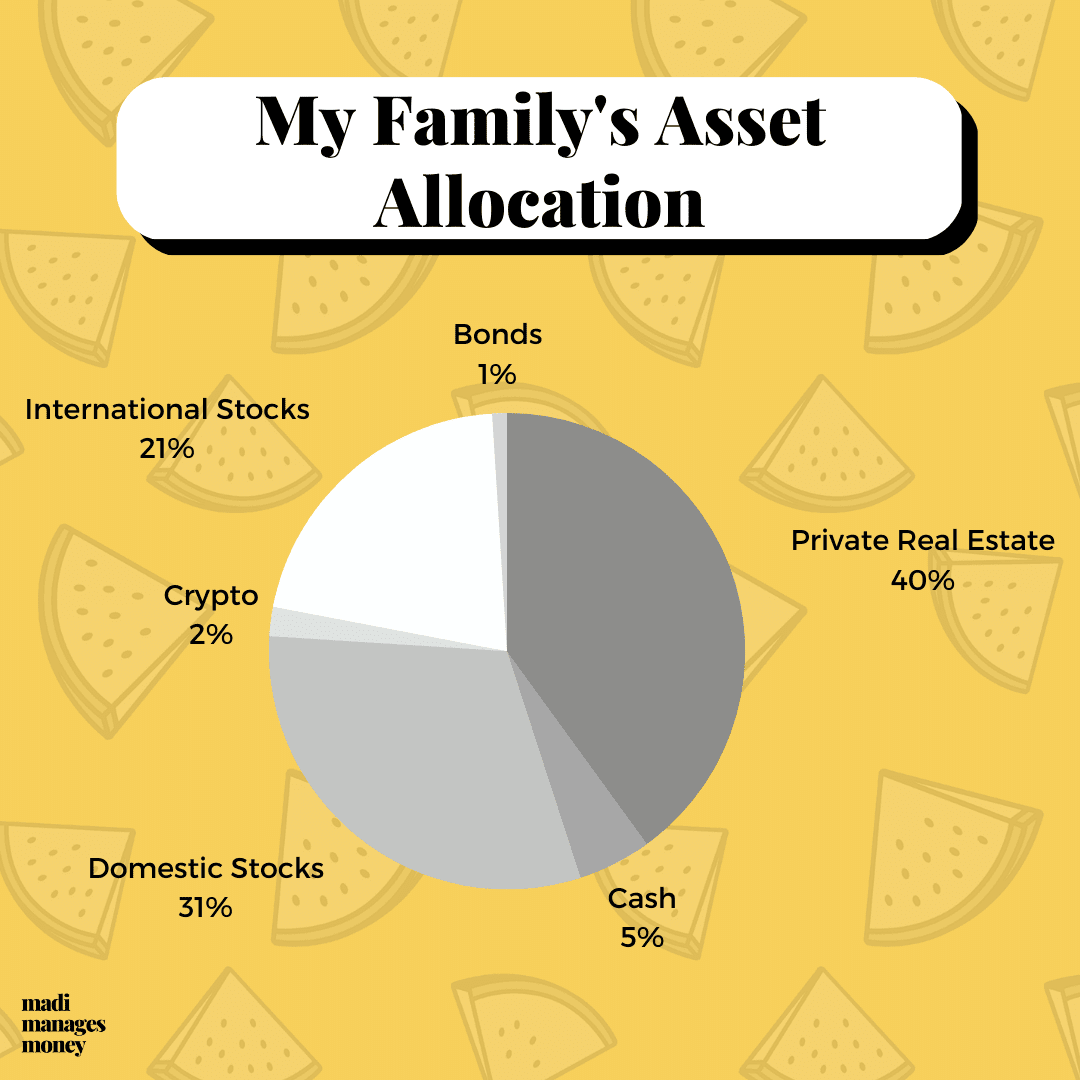

As of July 23, 2022, my family’s assets are invested like this:

- 40% – Private Real Estate

- 31% – U.S. Stocks

- 21% – International Stocks

- 5% – Cash

- 2% – Cryptocurrency

- 1% – Fixed Income

For context, we’re a family of 3 👨👩👧 living in Pittsburgh, PA. The assets belong to my husband and me, who are both 32 years old. We have a one-year-old baby girl.

My husband is our sole breadwinner as of last month, whereas your girl is the manager of our family finances, including our investments. I’ve spent the better part of the last decade managing portfolios for retail investors. Doing exactly this with billions of dollars has been my day job.

We have a long investment time horizon and an aggressive risk tolerance. We’re willing to ride out down markets (like rn 😈) in order to achieve higher returns over the long haul.

Our money is spread across the gamut of account types, like Roth IRAs, 401(k)s, and HSAs, that we’ve accumulated. Each of these serve a purpose within our tax strategy.

This post looks more closely at what we hold in those accounts. In short, we invest in things like target date funds and low-cost index funds. No crazy leverage, complex options strategies, nothing I have to actively research or manage. I don’t even pick individual stocks.

Here’s why we’re invested the way we are.

Domestic Stocks + International Stocks + Bonds = 53%

The majority of our money is invested in traditional markets, with the bulk of that being in stocks. I keep so much here because our time horizon is long, and equity has the most potential to grow.

With that growth potential comes risk. Stocks are also the most likely to fall in price over periods of time, too.

We’re not going to touch this money until we’re at least in our 60s, so our portfolio will have time to recover even in the event of major down markets. No matter the weather, we ride it out and continue regularly investing.

Our split between countries is about 60% in domestic and 40% in international stocks, which is a pretty standard allocation if you’re paying someone (like an advisor) to do it for you.

I’ve reviewed hundreds, maybe thousands, of self-constructed client portfolios, and a common mistake that I see is not investing in international stocks. The good ole U.S. of A 🇺🇸 isn’t the only game in town.

In fact, economic trends suggest that our country isn’t going to be the growth engine that it once was. It’s true that investing in other countries introduces some unknowns into your portfolio. But, you also get diversification and exposure to growing markets. To me, that tradeoff makes sense.

As for our measly bond exposure, it’s a sum of residual holdings within the mutual funds and ETFs that we have. I haven’t deliberately sought out dedicated fixed income exposure given our higher risk tolerance and long time horizon.

When you’re in your 20s, 30s, or even 40s, you don’t need much bond exposure in your portfolio. Even a 10% allocation to fixed income would be on the heavy end for someone with that long of a time horizon. Take risk while time is on your side.

All of this investment exposure comes from purchasing low-cost, diversified mutual funds and ETFs, not researching and selecting stocks. The mutual funds and ETFs we invest in are either target date funds or diversified stock market indices.

In most accounts, I hold just one investment because that one holding is so diversified. Diversifying beyond that wouldn’t necessarily hurt anything, but it’s also excessive.

Could I research and select individual stocks? Sure. But, over a long period of time, the returns I’d achieve will likely be pretty similar to what I’d get investing in a low-cost index. That’s a lousy use of my time.

Private Real Estate = 40%

Our real estate portfolio is made up of two properties 🏠 🏠 in Pittsburgh, PA. One is our primary residence, and the second is an investment property. We purchased these in 2018 and 2021, respectively.

Right now, real estate is the highest proportion of our portfolio that it’s ever been. Under more normal circumstances, it tends to be like 35% of our assets, at most.

While the stock market has fallen through the first half of 2022, prices in the property market have held steady, acting as a diversifier within our portfolio. This has played out well for us, but admittedly, I didn’t draw it up quite like this.

Aside from being a place to literally live, we purchased property to diversify our higher-risk equity positions (instead of investing in bonds) and to earn some rental income.

As real assets, I did expect property prices to be less volatile that the stock market. Further, private real estate tends to have a lower correlation to stocks, which means it zigs when the market zags.

The part that I didn’t expect is the level of price appreciation we’ve gotten in such a short time. Of course we hoped for some, but that wasn’t our core investment thesis.

Our next real estate move will be selling a property. Our primary residence has tripled in value since we bought and renovated it, and we own it outright. For me, that’s too much equity sitting in a house.

I’d much rather sell and invest the proceeds in the downpayment of another house with a mortgage, then plunk the rest of it into the stock market. Our money will work harder for us that way.

Before that, I have further research to do to ensure we take advantage of the IRS Section 121 exclusion. This cute little tax law is one we’ve used in the past. It can save you from paying capital gains taxes on the sale of your primary residence.

This rule is also why I’d always recommend consulting with a CPA before you even start the process of selling your house. Paying a couple hundred bucks to a consultant up front can save you tens of thousands in taxes.

I’ll do a dedicated post on our adventures in the housing market at a later date. My husband and I could have an entire blog (genre: squarely in comedy) about our renovations. We’d call it Almost Renovated, because what they say is true – the renovations are never finished.

Cash = 5%

Our cash represents our emergency fund. We tend to keep 3-6 months worth of living expenses in cash, just in case.

Historically, we’ve hovered closer to three months’ worth of expenses since we had two incomes. Since leaving my job and becoming a party of 3, we’ve moved closer to six months’.

We need a little extra cushion since we aren’t bringing home the bacon as rapidly as we were with two incomes. Generally, though, I believe in staying fully invested and don’t allow our cash balances to breach that six months’ worth of expenses.

Cryptocurrency = 2%

For starters, I’m a crypto investor and not a crypto trader. At times, this position has constituted up to 5% of our assets.

Today, after a brutal several months of the 2022 crypto winter, it makes up about 2% of our portfolio. If nothing else, let this section read as a notice to proceed with caution.

In my opinion, cryptocurrency has become a legitimate, albeit super risky, asset class. These globally exchanged currencies now have significant financial infrastructure built around them (i.e. payments, borrowing, investing). It’s here to stay.

Our specific holdings, Bitcoin and Ethereum, were definitely a regret-minimization purchase that we made a little over a year ago. Given our higher tolerance for investment risk, I decided it was appropriate to add a sliver to our portfolio.

The key word here is sliver. This is not a place for betting the farm.

If you’re ever tempted to plow a large portion of your money into something that maybe, just maybe, could make you rich quickly… just remember that there are equal chances that that investment rips your face off. 😬

If you look at the grand scheme of our portfolio, we’ve dipped a toe. To us, it’s desirable to have a hand in the growth potential of cryptocurrency, but I’m not willing to negatively impact my family’s livelihood with exposure to the asset class.

We knew going into it that volatility was a likelihood, and we don’t engage in speculative trading. Instead, we own our currency holdings for their long-term gain potential as they mature.

I’ll be sitting tight with this position 💎 and potentially adding a smidge more.

How should I use this article?

This is the part where I remind you that this isn’t investment advice. Everyone is different, and I can’t give specific advice to you without knowing your unique situation.

But, there are actionable parts that you can take away to implement on your own if they’re relevant to you. Most of these points align with generally accepted investing principles.

Here we go:

- Diversified, low-cost investments tend to outperform active managers who charge a higher management fee over time.

- Don’t worry that you’re missing out on returns if you’re not actively investing or picking stocks. You’re probably outperforming Chad, the aspiring day trader over in Accounting, if you’re invested in a target date fund.

- Your time horizon should be the primary determinant of the amount of risk you take.

- Long time horizon = more stock exposure

- Short time horizon = more bond exposure

- Real estate and crypto have gotten a lot of recent investor attention, but they’re not where I plan to invest the bulk of my money for the long term. Is there a chance that they’ll out-earn stocks? For sure. But, if history is any indicator of what to expect from the stock market in the decades to come, I know my family can meet our financial goals with those returns.

That’s it. Use this post as a benchmark for your own strategy, where applicable. What I’ve implemented might not be flashy, but it works.

Related Post: How to DIY a Diversified, Low-Cost Portfolio

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.