This article outlines some unconventional ways that we’ve adjusted our family budget that you might consider, too.

As a refresher and for context, we’re a family of three living in Pittsburgh, PA. We own our home and a car outright but have a mortgage on an investment property.

More adorably, we have a one-year-old daughter, plus two cats and a dog. As of writing, I’ve been on a Corporate America hiatus for about four months, and my husband continues to work full-time from home.

If I had to identify a family budget theme of the past several months, it would be financial minimalism. We’re managing our money in ways that maximize the time we have to live the way we want and decluttering the rest.

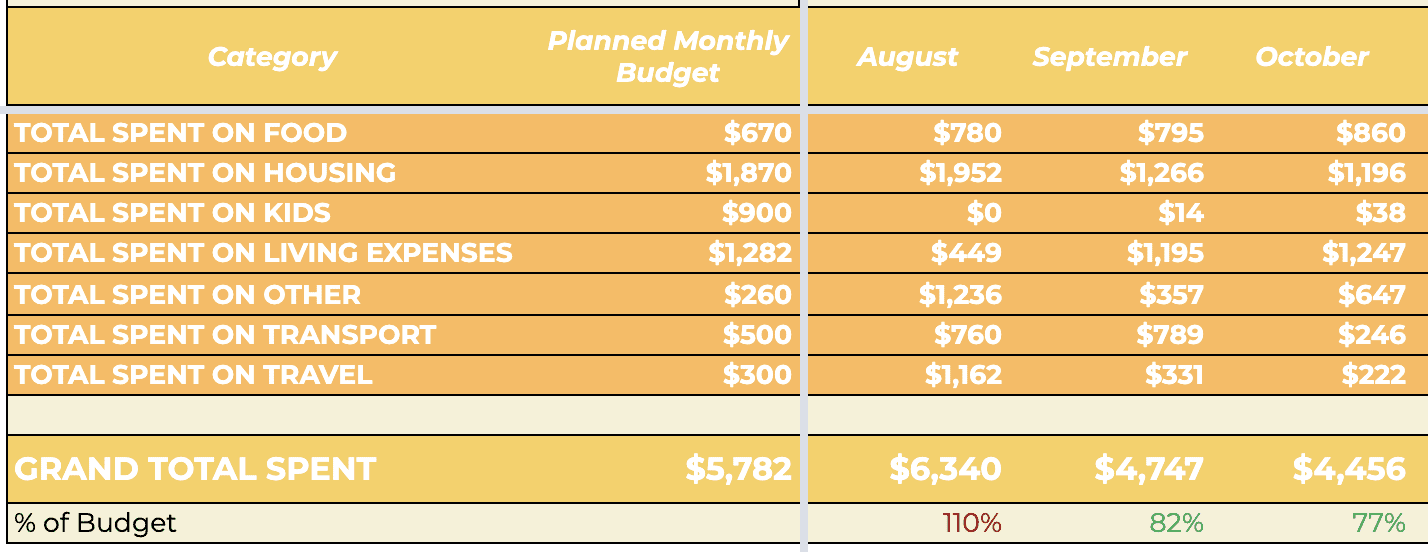

Updated Monthly Budget: $5,782

- August Actual Spending: $6,340

- September Actual Spending: $4,747

- October Actual Spending: $4,456

Have this budgeting template delivered to your inbox.

What’s New? Peeking Under the Hood

We started a nanny share this month with a wonderful family nearby that my daughter attends two days a week. This frees me up to work on something that sparks joy – writing this blog – and it gets her out of the house with another toddler & caretaker.

The middle ground I’m seeking has plenty of quality time with her but also enables me to write this blog more seriously. We’re not afraid to try new things around here, so we’ll continue tinkering until we find the right balance. 🛠

At the risk of stating the obvious, childcare is the primary reason for our new, higher Kids budget of $900. Our portion of the nanny share rate is about $13 per hour, which adds $850 per month to our family budget.

Another big change is that we sold our 2020 Honda CR-V to Carvana for nearly the purchase price I paid two years ago. Since we don’t commute to work anymore, it wasn’t serving us. Plus, we figured we’d take advantage of head-scratchingly high used car prices while the getting was good.

Selling our car cuts out a $400 per month car payment, plus insurance, from our Transport budget. It also brings our 2008 Honda Odyssey minivan out of retirement as our primary vehicle. (You didn’t know I was gonna flex on you like that.)

Family budget lowlights include garden variety medical surprises, like surgery for our cat who had a tumor removed ($500) and dental work for me ($460). It also includes pediatrician visits for two ear aches for my daughter, one real and one imagined. All of these figures fall into Living Expenses.

Flirting with Financial Minimalism

Financial minimalism is managing your family’s income, expenses, and investments deliberately to align to your values. I think of it as factoring time as a second currency ⏰ into the family budget equation, in addition to money. Often, it looks like simplifying your finances.

Joshua Fields Milburn, who’s most well known for being one half of The Minimalists (on Netflix), put it like this: “It takes time to earn money, and my time is my freedom, so by giving up my money I’m giving up small pieces of my freedom.”

Without realizing it, my husband and I have been flirting with financial minimalism for quite some time. Nevertheless, it’s been an evolution, especially for me.

The earlier years of my adult life were spent maximizing the amount of money I made at all costs. In my 20s, you could find me working, studying, or renovating houses during most waking hours.

But suddenly in summer of 2021, when a new little sheriff came to town, the ‘work’ side of my work-life balance equation was confronted with a formidable foe. Time as a currency became so much more precious.

Deciding to leave my high-paying finance job to appreciate time with family was probably a decisive enough symptom, but it took further reflection on our recent choices to self-diagnose as financial minimalists.

(I speak for myself here. When I explained to my husband that I’d categorize us as financial minimalists, he raised his eyebrows and gave me an, “Oh, I know,” with Captain-Obvious undertones. 😭)

To me, cars are a utility from which I derive very little satisfaction. Prior to owning a new CR-V, I proudly drove a 2003 Toyota Corolla that had a silver, spray-painted dick on the window from neighborhood teenagers. (No, I couldn’t get it off.)

This Corolla had about 140,000 miles on it, you heard it before you saw it, but I was smitten – because I never had to worry about it. In fact, the morning of the phallic incident, I was beside myself…with laughter.

My new car, on the other hand, gave me the opposite feeling. I spent more time worrying about it parked on a busy city street than I actually spent driving it. For the pleasure of harboring this worry, I shelled out $400 each month. Quintessential financial clutter.

Financial minimalism doesn’t always mean spending less money, though.

Our decision to hire childcare for our daughter fits the mold, too. Reclaiming two days of the week to pursue something I’m passionate about feels like a much better balance for our whole family.

Now that we’ve put a name to our family budgeting philosophy, I’m excited to explore this newfound identity.

Free Budget Template: Coming Soon

Reflecting on our spending in 2022 – the first year that we truly created & stuck to a family budget for the duration – I’ve been humbled. I wish I would’ve started sooner.

Even after downsizing to one full-time income, budgeting enabled my family to keep all of our assets in the market and invest even more for the future. After all, that’s the only trick to building wealth over time.

Like any good scheming, most of this madness occurred in a spreadsheet that you can use, too. Sign-up to have it delivered to your inbox here.

Here’s to crafting the life you want in the present while investing for your future.

Madi 🙂

Resources:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.