Take a guess. What size inheritance can Americans give at death before being taxed by the IRS?

I’d wager that most reasonable estimates would come in at several hundred thousand dollars. Maybe a million?

If that’s where your mind drifted to, prepare to be shook to your core.

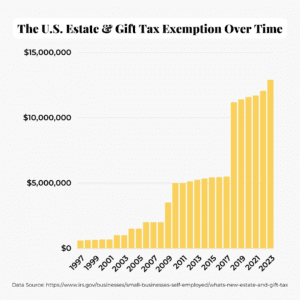

Meet the federal estate and gift tax exemption.

The federal estate and gift tax exemption is the cumulative amount of money Americans can give to heirs over our lifetimes, plus at death, without having to pay federal estate taxes.

In 2023, the exemption stood at $12.92 million per person.

Any money left to a surviving spouse passes free of the tax, no matter the amount. Plus, the exemption is portable between spouses, so double it for married couples.

Yes! That means a wealthy couple could pass $25.84 million to heirs and never pay a penny in federal taxes on their estate. The estate and gift tax exemption, in large part, explains how the rich stay rich.

Against a backdrop of widening economic inequality and a floundering U.S. Social Security System, this makes me scratch my head.

For a couple, today’s exemption sits at 212 times the $121,700 median net worth of American families.

How do federal estate and gift taxes work?

Think of estate and gift taxes as one and the same. Over a lifetime, including at death, a married couple has a cumulative sum of money – a cool ~$25.84 mil – they can give before triggering the tax.

Additionally, $17,000 (as of 2023) can be given each year without dipping into that cumulative sum. This is known as the annual gift tax exemption, and I’d liken it to slipping money under the table to friends and family members. Completely legally.

Here’s a simple example.

Take a wealthy couple with $30 million in assets. We’ll assume any gifts they made over their lifetimes fell below the annual threshold, so the full $25.84 million exemption is available to them.

Taxes come due at the death of the surviving spouse. To determine their taxable estate, the exemption is subtracted from their gross estate. It acts as a haircut right off the top, like taking the standard deduction on income taxes.

Finally, the effective estate tax rate is applied to arrive at their tax bill. As of 2023, the maximum tax rate is 40 percent.

- Gross Estate – Estate & Gift Tax Exemption = Taxable Estate

- $30 MM – $25.84 MM = $4.16 MM

The annual gift tax exclusion plays a clutch role in how the rich stay rich. Because it’s per gifter, per recipient, annual gifts are awfully potent, especially in large families with many beneficiaries.

For instance, take a set of grandparents wanting to reduce their estate who have four adult children and ten grandchildren. They could give $476,000 every year without even touching their cumulative exemption amount.

- 2 Gifters * 14 Recipients * $17,000 = $476,000 Annually

If you extend an annual gifting strategy over a lifetime and combine it with the cumulative exemption, it’s no wonder that only ~1,900 estates pay tax per year. That’s less than 0.1 percent of the ~2.7 million people who pass away annually.

How’d we get here? A brief history of the exemption.

The federal estate and gift tax exemption hasn’t always been so high, and today’s levels are temporary. It was doubled as part of the 2017 Tax Cuts and Jobs Act from $5.6 million to $11.2 million.

The amount has been adjusted for inflation since then, reaching today’s $12.92 million.

Source: IRS

Come 2025, the Tax Cuts and Jobs Act is set to expire. It’s likely that the estate and gift tax exemption will be reduced back to the range of $6-7 million per person at that time.

Meanwhile in America…Wealth inequality surges.

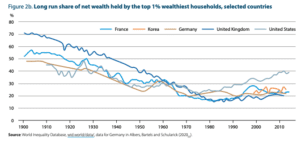

Over the past several years, wealthy families in America have transferred more money to heirs free of federal estate tax than ever before. Uncoincidentally, we’ve seen our country’s wealth concentrate further to households at the tippy top of the net worth distribution.

According to a global study on inheritance taxation by the OECD, nearly 80 percent of all wealth in the U.S. is owned by the top ten percent of families. Over 40 percent of wealth is held by families in the top one percent alone.

Among other developed nations, the U.S. is already an outlier when it comes to financial inequality, and we’re trending in the wrong direction.

Source: https://www.oecd.org/tax/tax-policy/inheritance-taxation-in-oecd-countries-brochure.pdf

In comparison, the bottom 50 percent of Americans, as measured by net worth, own only 3.3 percent of all wealth. This is according to data from the Federal Reserve as of Q3 2022.

It goes without saying that the past few years have dealt no shortage of challenges to everyday Americans. The Pandemic disproportionately hurt the working class, who rely on steady employment in sectors like the service industry to make ends meet.

A soaring real estate market followed, pricing families and first-time buyers out of home ownership. Then, came the inflation crisis.

Simultaneously, asset owners solidified their status. Families who already owned significant wealth benefitted handily from monetary stimulus (i.e. lower interest rates, bond buying by the Fed) that buoyed the price of their investments.

So, no – the inflated estate and gift tax exemption isn’t the only explanation for how the rich stay rich (and get richer). Plenty of other factors are at play that give the already-wealthy a leg up.

But, it doesn’t take a PhD in economics to see how removing a key mechanism to redistribute wealth only increases its concentration at the top.

Investing is the equalizer.

This wasn’t my most practical post, but I also hope it didn’t read as defeatist. The mind-bogglingly high estate and gift tax exemption is a definite contributor to how the rich stay rich, but so is investing.

That part, anyone can mimic.

Investing regularly for the long term is the only secret to accruing wealth. Storing money in a savings account alone won’t get you there.

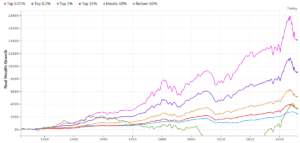

The chart below shows asset growth by wealth segment. The pink and purple lines at the top of the chart – the ones that belong to the wealthiest Americans – shoot straight up and to the right for a reason.

Without exception, they’re invested heavily in the stock market.

Source: realtimeinequality.org

Decades ago, you needed a large chunk of money before you approached a broker to invest. That’s where the outdated notion that you need to be wealthy to start investing was born.

The reverse is true today. Investing is how you get wealthy, not something you wait to do until after you’re flush with cash.

Anyone with a smartphone and ten extra bucks can start. No matter how small, by making consistent investments into low-cost, diversified index funds over time, you’ll be impressed by how much money you can accumulate.

Related: How to Start Investing with $10

Resources:

- Actuarial Status of the Social Security Trust Funds

- Inheritance Taxation in OECD Countries

- Federal Reserve: Distribution of Household Wealth Since 1989

- Realtimeinequality.org

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.