Here’s an update on our family of 3 budget. We’ll touch on some HSA hacks, the catch with “no-interest” financing, and our savings rate.

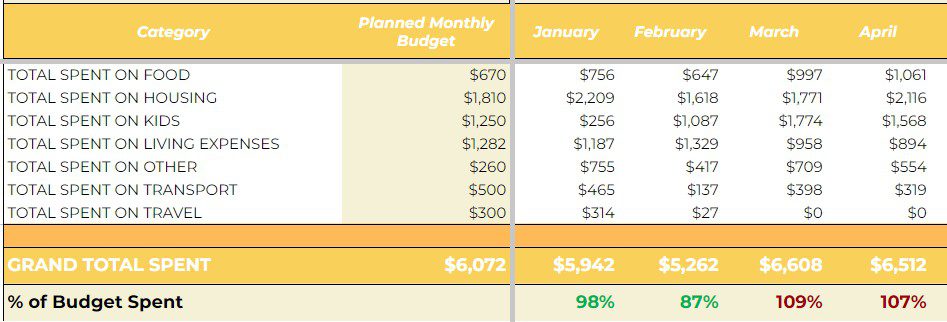

Our family of 3 budget update in 2023 is that we’ve spent $33,324 through April. This includes about $10,000 for a new roof on our rental property next door, so truly, our living expenses (below) have been closer to $24,324. This compares to our planned spending of about $24,288.

Roof aside, that’s pretty damn close to where we want to be. I’ll take it!

You can download my spreadsheet to use on your own here.

We’ve raised our planned spending in a few categories, however, which feels a little like moving the goal post. Let me explain…says everyone, ever, who has gone over budget.

Starting in March, we accepted a daycare spot for our daughter at a school that met our standards in Pittsburgh. Since then, our childcare costs have been over-budget compared to what I was projecting to start the year, when she was only attending a part-time nanny share 2 days a week. For the rest of the year, we’ll settle in at about $1,200 a month in childcare.

At the end of last year, I had Lasik eye surgery, which cost $3,850. My contact prescription was beyond -8.00 in both of my eyes, so yes, this has been a major quality of life upgrade. I’m still shaking the habit of reaching for my glasses when I wake up like Velma from Scooby Doo.

Unfortunately, Lasik surgery isn’t covered by insurance – mine wasn’t, anyway – but I was able to take advantage of 0% financing for one year. I also chose not to use any of my HSA funds to pay for this, which might have you scratching your head.

HSAs come with a triple tax benefit, which means they:

- Earn you a tax deduction when you contribute

- Grow tax-deferred, and

- Can be used tax-free on healthcare at anytime.

If I could put even more money in one, I would, because there’s no other account quite like it. Think of your IRAs for instance. You get a tax break either now or in retirement, but not both, which is what the HSA gives you. Because I want to maximize the tax-free status of the few precious dollars I can put into my HSA, I’ll let this money grow for a longer time. I’m better off paying for healthcare expenses with money I’ve already paid taxes on.

But, I will hoard my $3,850 receipt! The ultimate HSA hack is that you can reimburse yourself from your account for a documented healthcare cost anytime in the future. If I wanted to, I could save my receipts until I’m 65 and then withdraw a chunk of tax-free assets for those expenses.

Back to no-interest financing

No-interest financing seems too good to be true, so you’re smart to look for the catch. But as long as you play by the rules, there’s really not one.

No-interest financing is a no-brainer as long as (1) you’re not buying something just because you don’t have to pay for it now, and (2) you actually pay off the loan during the no-interest term.

I have an autopay set for $400 a month to make sure I do just that. Another way I could do it is pay off the balance in a lump before eclipsing the one-year mark. It doesn’t matter how you slice it and dice it, just pay it off before the clock strikes midnight.

If I’d carry my balance beyond year one, things would get ugly. This liability effectively morphs into a credit card, charging an interest rate of 26.99%.

Paying for my Lasik surgery falls into the “OTHER” category of our family budget.

In other exciting news, I’ve returned to work!

I’m working on Madi Manages Money full time, which probably looks a little different than you’d guess. Right now, I’m only spending about 10 hours a week on writing this blog and creating other content. The remaining 25 I spend contracting out my time to financial advisors who use me as an outsourced financial planner in their business. I also take freelance writing jobs when they pop up.

It’s this “invisible” part of my business that’s making me money. The freelance writing jobs I do tend to be more technical investment writing, which fetches about $1,000 per article. Outsourced financial planning at my experience level pays anywhere from $100 to $150 an hour, depending on how hard my brain needs to work for that engagement. If smoke starts coming out of my ears, I may need to up my rates.

Even though this blog doesn’t directly make money for me, it’s enjoyable to write and has become my proof of work. For freelance writing and even financial planning work, my partners decided to take a chance on working with me because they were able to get a sense of what I’m about before they ever contacted me.

My goal is to continue to shift more time toward creating Madi Manage Money content going forward. Eventually, it will entail registering my company to give financial advice to my own book of clients. This is a commitment and will require jumping through new compliance hoops and costs, but for the prospect of working with some of you, it will be worth it!

For now, I don’t see myself returning to a full-time gig in an office working for anyone else. As I approach the one-year anniversary of leaving my corporate job, I’ve been reflecting on my choices, and I’m happy with where I’ve landed. In absolute terms, I’m not earning as much, but if you consider how much time I spend working now versus what I earn, my hourly rate is higher. As the parent of a young child, I’ll take that tradeoff any day.

Our savings rate👛

I started budgeting more intensely when I left my job, when my family needed to downsize our budget to operate on one income. When I was a full-time SAHM, we insourced quite a few things that I’ve now started to outsource again, like childcare and eating out a little more (which is partly the culprit behind our way-over-budget FOOD totals.) Now that I’m spending my time differently, I’m willing to loosen the reins a little.

This is the part where I’ll have FI/RE hardos rolling their eyes. Lifestyle creep is slapping me right in the spreadsheet!

Sure, we could double-down and increase our savings rate even further, but honestly, our rate is already pretty high. Your savings rate is simply the amount you save divided by your after-tax income. Here’s a savings rate calculator if you’re interested in what your number might be.

Thanks to being in a LCOL area and being moderately high earners, we came in with a 45% savings rate for all of 2022, even with me only working half a year. My husband and I, by nature, are somewhat frugal. To further press the issue of intensely budgeting while we’re both working has diminishing marginal returns. There’s a tangible benefit of ordering Thai food at the end of a long day instead of starting dinner with an empty tank, and it’s called staying married.

Run your family budget like a business.

I think of my family of 3 budget like operating a business. There will be times when you should play it more conservative by reining in spending, like if you’re getting ready to make a big purchase or a lose a revenue source (like a job). But, there are also times when you need to spend money to make money without going nuts. That’s where we’re at right now.

If you’ve never done it, I implore you to sit down and tally up what you spend over a few months. Until you rip the band aid off by looking closely at your expenses, you don’t know what you’re actually spending.

The truth is, I only check in on how we’re doing every 2-3 months to ensure my family stays on the rails. In part, this is because I’ve dug into our family of 3 budget enough times to develop a feel for realistic monthly spending without hovering over it. It’s also because cutting our expenses any further isn’t going to have as much of an impact on our long-term net worth as focusing on growing our income.

Once you have the expense side under control, redirecting your focus to the offensive half of the equation is what will build wealth for your family over time. In theory, income growth is limitless, whereas you can only cut your expenses so much.

What’s Next?

Now that I’ve jumped back on the earnings train, I’m excited to continue investing. (This is a sickness you may one day contract, too.)

For the rest of 2023, I plan to invest primarily in a Solo 401(k). Opening this account is next on my to-do list, and I’ll report back on anything valuable. The rest of my Madi Manages Money excess cash flow will likely go back into my business to pay for compliance and registration costs to register as an investment advisor.

This will be months down the road – gotta make sure I’m doing everything above-board with the regulatory powers that be! – but here’s where you can sign up for my client interest list. There’s no commitment. You’ll be the first to know once I’m launched and have a formal suite of services, is all.

Thanks for reading!

Madi 💛

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.