Spousal IRAs can balance ownership of investable assets between husband and wife.

You know the arrangement. Husband goes to work, earns income. Wife stays at home with kids, does unpaid labor. Everyone plays a part to progress as a unit.

But who’s progressing? Financially, it’s primarily husbands. American women own just 32 cents of wealth for every $1 owned by men, according to the Closing the Women’s Wealth Gap Report from 2017.

More often than not, excess income that isn’t consumed by the family budget is placed in investment accounts titled in the husband’s name. In fact, this happens by default when men have greater access to benefits like 401(k) accounts as a term of full-time employment.

Counter to the trend, spousal IRAs are a way to invest money held directly in the name of the non-earning spouse. Contributing to one is a step towards maintaining financial equity in marriage when one spouse takes a career break to lean into family life.

What is a Spousal IRA?

A spousal IRA is a tax-advantaged investment account held directly in your name as the non-earning spouse. Your partner’s income is used to fund it, which maximizes family tax savings and assets invested for retirement. In 2023, you can put up to $6,500 into a spousal IRA if you’re under age 50.

A spousal IRA could be opened as a Roth IRA or a Traditional IRA. It’s not, however, a specific type of account in and of itself. In other words, a “Spousal Roth IRA” or “Spousal Traditional IRA” isn’t a thing. You simply open up a regular IRA in your own name as the non-working spouse.

For the record, I’ll use the term “non-working spouse” throughout this article, but it’s not because I believe there’s anything “non-working” about it. (Can verify. I’ve done it.) But, to keep terminology straight, we’ll roll with it.

So, what’s so special about the spousal IRA? Well, to contribute to any IRA, usually you need to have earned income during the year you add money to your account. Making IRA spousal contributions is one of the very few exceptions to this “earned income” rule.

To make an IRA spousal contribution, you must be married, filing jointly. Also, your family’s joint income must meet or exceed the total family contributions made to any IRAs, including your partner’s + your own IRA spousal contribution.

Why Make IRA Spousal Contributions?

Distribute Assets Equally; You’ve Earned Them

A spousal IRA can create more equal financial footing in a marriage, especially if you take a career break or are a SAHM. During your years with low to no annual wages, a spousal IRA is a tax-advantaged ticket to investing for your future, in your own name.

Now, you might be thinking it shouldn’t matter who the investment accounts belong to, as long as the money’s invested for your family. If that thought crossed your mind, please come to a screeching halt.🛑

Although virtually no one thinks they’ll get divorced – otherwise, why get married in the first place? – nearly half of all marriages in the U.S. end that way.

For better, for worse, or until death do you part, you still want assets in your own name. Without them, you’re putting your future financial security, and potentially that of your kids, at risk. Don’t rely on the courts or waning goodwill between you and an ex-spouse to divvy up assets.

I think of it like this. As the non-working spouse, you orchestrate the family ecosystem that enables your partner to earn an income. This is so much more than just “staying at home with the kids.” It’s packing lunches, night wakings, school forms, doctor appointments, social calendars, and keeping mental stock of every grocery and toiletry in your house.

Put morbidly, if you were to pass away, your husband would suddenly have a lot more to do than simply hire a sitter. For your contributions, you should share equally in your family’s financial success. Expecting anything less is highway robbery, maybe gaslighting at best.

Maximize Family Tax Savings

IRA spousal contributions can have some sweet tax benefits. What you qualify for will depend on how much money your family makes and whether you choose a Traditional IRA or Roth IRA.

A Traditional IRA will get you tax-deferral on investment gains and dividends while money remains in the account. Come retirement, you’ll owe income tax on withdrawals. Your contributions might also get you a tax deduction in the year you make them.

No matter how high your joint income is, you can always contribute to a Traditional IRA. The part that changes as you make more money is whether or not you can deduct your contribution to lower your taxable income.

Deductibility depends on two things: (1) how much money your family makes, and (2) whether or not the earning spouse is covered by a work retirement plan.

If your partner is covered by a work retirement plan, deductibility of Traditional IRA contributions get phased-out starting at a joint modified AGI of $116,000. If the earning spouse is not covered by a work retirement plan, deductibility phase-out starts at $218,000. Here’s a link to the IRS rule.

A Roth IRA is funded with money you’ve already paid taxes on. Once it’s in the account, it grows fully tax-free forever, as long as you wait until after age 59.5 to use it.

You can be precluded altogether from making IRA spousal contributions directly to a Roth IRA if your family’s income is too high. In 2023, those limits start at $218,000 in joint modified AGI.

(If you’re like, “What in the fresh hell is modified AGI?!” ask your tax preparer what type of IRA you’re eligible to use. You can contribute to one until the tax filing deadline for the previous calendar year.)

Tax savings are what makes IRA investing superior to just putting the money in a taxable brokerage account, assuming this is retirement money. I’d definitely consider a taxable account to supplement your spousal IRA, though! Being realistic, investing $6,500 for your retirement isn’t enough.

Frequently Asked Spousal IRA Questions:

What are the IRA spousal contribution limits?

In 2023, the IRA spousal contribution limits are $6,500 per person. This maximum is consistent with the contribution limit for all types of IRAs.

If you’re age 50 or older, you’re eligible to make an additional $1,000 “catch up” contribution per year, which increases your max to $7,500 per person.

Example: A married couple, filing jointly, who is under the age of 50 could each put $6,500 into their own IRAs, totaling $13,000 in IRA contributions as a family.

Who can make IRA spousal contributions?

You or your partner can make IRA spousal contributions on your behalf. It’s not important who makes the actual contribution. Instead, it’s important that you’re married, filing a joint tax return, and your earned income as a family exceeds the total amount contributed to your IRAs.

Should I still make IRA spousal contributions if my family doesn’t qualify for a tax deduction?

Generally, yes, as long as this is money you can leave invested for a while.

If your family is over the joint income limit to qualify for a tax deduction on IRA spousal contributions to a Traditional IRA, contributing still has benefits. You’ll get ongoing tax-deferral on investment growth in your IRA. This means that you won’t get taxed each year if you sell investments at a gain or on any dividends you receive.

Putting money into a Traditional IRA also enables you to rollover money to a Roth IRA. You could do it immediately or in the future. For the uninitiated, Roth conversions are how high-earners get money into a Roth IRA even if they’re over the income limit to contribute.

When should I make IRA spousal contributions?

You can make IRA spousal contributions up until the tax filing deadline every year. For example, to make an IRA contribution for 2022, you could have funded your account anytime from 1/1/2022 and 4/18/2023.

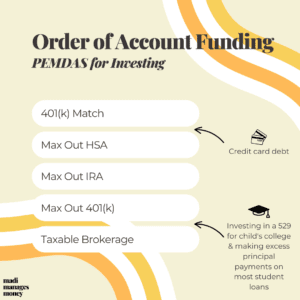

You might also consider order of account funding. To follow a tax-efficient sequence of account funding, I recommend the following process. I’d make an IRA spousal contribution at the third step, but remember, we’re optimizing here. Even if you don’t follow the sequence perfectly, that’s okay.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.