Here’s why millennials shouldn’t take the claim, “I’ll never see a dime of Social Security,” at face value & why blindly repeating it does a disservice to our generation.

“Millennials won’t see a dime of Social Security,” is a thought-terminating cliche that captures the sour sentiment of an entire generation. It’s also wildly inaccurate.

Anecdotally speaking, this phrase is so common that it has snuck its way into virtually every conversation I’ve had with peers about retirement plans.

Give it a go yourself. Mention Social Security to friends in an open-ended manner and pause until someone offers their two cents. (This has the added benefit of making you extremely popular.) I can all but guarantee you’ll hear a regurgitation of our opening quote.

Data backs up my observation. According to a 2022 survey by HealthView Services, almost half of millennials born between 1981 and 1996 agree with the statement that they “won’t get a dime” from Social Security benefits, despite paying into the system for decades. This was reported by USA Today.

Here’s how the Social Security system actually works, what shape it’s in, and what benefits you can expect to get. Social Security isn’t as caked-up as it has been at times, but it’s also not broke. That is, unless we create a self-fulfilling prophecy.

How does the Social Security system work?

Social Security collects tax receipts from working Americans and redistributes the money to people who need it – like retirees, the disabled, and survivors. For the purposes of this post, we’ll primarily be focusing on retirement benefits.

On the surface, the formula seems logical. Younger workers pay into the system during our careers via payroll taxes. You know the ones – the dreaded 7.65% tax coded as “SS” or “FICA” on your paystub. As of 2024, SS taxes are levied on the first $168,600 of your wages.

Your employer also pays an additional 7.65% to bring the total tax to 15.3%. If you’re self-employed, you pay the full 15.3% yourself.

Then, when we reach retirement, the promised land awaits…allegedly. We can file for Social Security retirement benefits at age 62 but can also delay until as late as 70. The longer you wait to file, the greater your monthly benefit. Then, a fixed check hits your bank account every month for the rest of your life, much like a pension.

Where do my payroll taxes go?

When taxes from our paychecks are collected, they’re deposited into one of two Social Security trust funds. One is for retirement and survivor benefits, and the other is for disability insurance. They’re often referred to generally as the Social Security trust funds without distinguishing between the two.

When current-year tax receipts aren’t great enough to fully pay for current-year benefits, the SSA dips into the trust funds to cover the deficit. When there’s an annual surplus, it goes into the trusts. The trusts invest in special U.S. Treasury bonds that pay interest but do not fluctuate with the stock market. They’re essentially Social Security’s rainy day fund.

Whether people realize it or not, when they say, “Social Security is going broke,” what they’re referring to is these trusts. And herein lies the rub…how much the program actually relies on the trusts to cover ongoing costs is a major point of confusion and contention. We’ll clarify that next.

Is Social Security going broke?

In 2023, about 98% of Social Security benefits paid were paid for by current-year tax revenue. The remaining 2% was covered by dipping into the aforementioned trusts.

This reliance on current-year tax revenue is by design and is the reason why Social Security is known as a “pay-as-you-go system.” As long as people continue to work and pay payroll taxes, Social Security will still be around.

But here’s where the long-term math ain’t quite mathin’. Baby boomers are the largest generation to ever retire, the youngest of which are turning 62 next year. Turning the retirement income faucet on for all 73 million of them is creating an annual deficit that will grow rapidly without reform.

In its annual actuarial report, the Social Security Board of Trustees reported in 2023 that the trust funds are projected to be depleted by 2033. Should it get to that point, just 75-80% of Social Security benefits would be covered by that year’s tax receipts. In other words, the pay-as-you-go mechanism will only over ~3/4 of the payments due.

Ideal? No. But this is more of an imbalance than an impasse, and America has been here before.

In 1983, just a few months before the trusts were scheduled to be depleted, sweeping Social Security reform was signed into action. These reforms slowly increased payroll taxes (more revenue) and raised the retirement age (lower expenses). The result was a Social Security program that produced an annual surplus between 1984 and 2009.

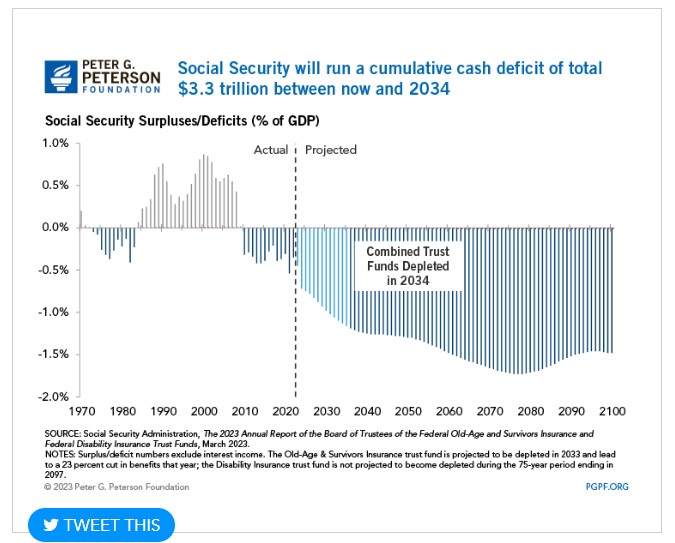

Here’s a look at annual surpluses and deficits, including actual & projected.

Source: Peter G. Peterson Foundation (PGPF.ORG)

What’s my Social Security benefit?

Even if you have decades until retirement, create an account with the SSA to determine your estimated monthly benefit.

Benefits are shown in today’s dollars and will be grown by a cost of living adjustment (COLA) into the future. For example: My current estimated monthly benefit if I’d retire at age 67 – my full retirement age – is $2,957. The SSA will grow $2,957 by the inflation rate from now until I’m 67. This amount could also change depending on my career trajectory.

As you’ve likely deduced by now, the SSA isn’t squirreling your paycheck deductions away into your own little account for later. Instead, all income is lumped into the trust funds. This is the beauty of or the problem with Social Security, depending on who you ask.

Your benefit in retirement, however, is still based on how much you specifically paid into the system, at least up to a point. It’s a formula calculated on your 35 highest-earning years. You don’t actually have to work 35 full (or straight!) years to get some benefits, but doing so is how you’d maximize your retirement checks.

To qualify for any benefit of your own at all, you must have worked (and paid into the system) for at least 10 years. Additionally, if you were a stay-at-home spouse who was married to someone who earned benefits, you’ll be entitled to filing spousal benefits upon retirement.

Social Security is designed to cover about 30% of your retirement needs, not the whole thing. So even though we’ll likely get some benefit, don’t let that stop you from investing on your own. Things like your 401(k) will still make up the bulk of your retirement money.

How millennials talk about Social Security is important.

I don’t expect you to be a Social Security expert. In fairness, it’s a long time until we collect retirement income checks. But we shouldn’t blindly criticize something until we’ve done the research. Otherwise, millennials could fall right into a trap.

Social Security requires reform to shore up its long-term solvency and soon. When legislators make changes – like delaying retirement ages, for instance – they happen decades ahead of time so the impacted population has time to make financial accommodations.

For example, when the landmark 1983 changes were made, the full retirement age was raised to 67 by 2027. That’s 44 years out from when it was approved. Guess who will be retiring 40 years from now? Millennials and our younger brethren (and spirit animals), gen z.

Baby boomers and some gen x, who are largely the politicians voting on these changes today, will be long gone. They’re also the point of origin of messages that Social Security is nothing but a sunk cost. If our generation’s stance is that Social Security going bust is a foregone conclusion, it makes to much easier for those politicians to scuttle our future benefits without pushback.

My hunch is you’ve seen the headlines or heard offhand comments. My hunch is you’ve absorbed them. My hunch is you’re assuming this is a future problem, not one for right now. As a financial planner for younger professionals, this all worries me that we will create a self-fulfilling prophecy.

The next time someone bashes Social Security, I hope you’ll (politely) take them a layer deeper on the subject. At the very least, you’ve added something new to your personal finance B.S. meter rolodex of triggers!

Thanks for reading. 😊

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.