The close of 2023 marks the end of my first calendar year as a female entrepreneur. Here’s how it went.

It was a year of evolution at Madi Manages Money. What started as a blog ended as fee-only financial planning business.

To begin the year, I did outsourced financial planning for other financial advisors (a business-to-business model). Then, in spring, right around the time my husband and I realized our family would be growing, I decided to register for my own financial advice business.

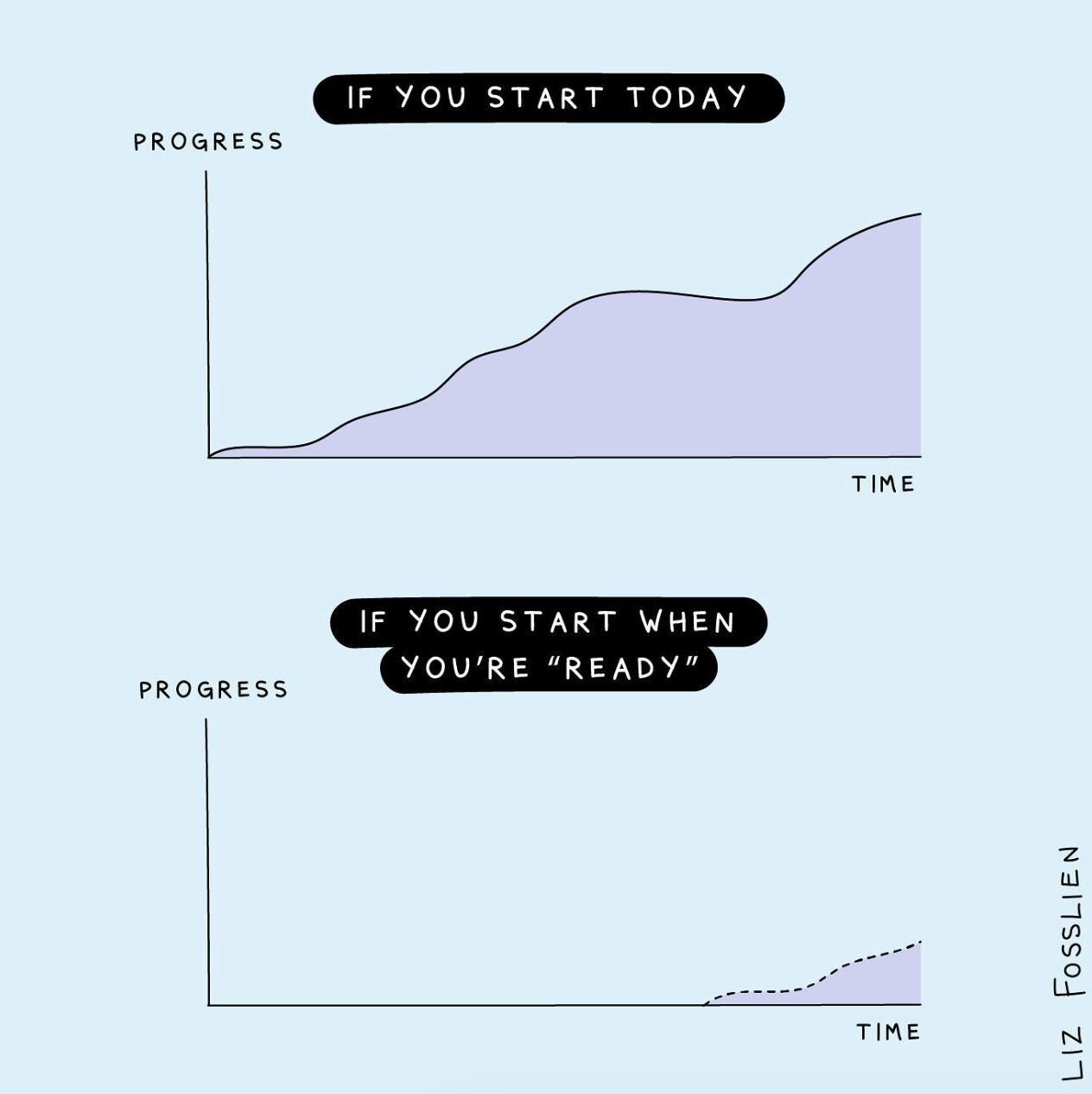

This wasn’t a spur of the moment decision – I’d wanted to deliver advice to my own clients for some time – but I was faced with the choice of getting things in motion or waiting until after Baby 2 made their debut. I’m glad I started!

This brings us to today. Since August of 2023, I’ve been a fee-only financial planner who works with women who lead their family’s financial decisions. It has been awesome.

Here are the highlights and lowlights behind year one in business, a year of imperfect beginnings.

The Highlights: Autonomy, Purpose, & Mastery

Autonomy

The best part of having my own business has been the autonomy. I’ve never needed much prodding to take action – insufferable self-starter, here 🙋♀️ – so I haven’t missed taking direction at a job. Thinking strategically to identify my next logical move, then actually doing the thing, is a muscle I trained in a previous life that has lent well to entrepreneurship. That’s not to say that I’m always making the right choices, but it feels…natural.

(If you’d ask my husband, I don’t like being told what to do. Also fair.)

The personal and professional flexibility this has granted me has been immense. A normal weekday for me looks like this.

- Early work session: 5:30am to 7:30am

- Get daughter to school, exercise, & get ready: 7:30am to 10:00am

- Daytime work session: 10:00am to 4:00pm

- Pickup daughter: 4:00pm

I never could have done this before with my previous job, when I schlepped my daughter out the door for daycare at 7:00am, only to arrive home at 6:00pm after battling traffic through the Squirrel Hill Tunnels (#iykyk). For my toddler, this equated to just one hour a day, five days a week, spent with her parents. That didn’t align with my or my husband’s vision for our family. Also, all parents know that 6:00 to 7:00 at night is the witching hour, the antithesis of quality time.

The lines between my work and home life have blurred. In the past, I may have listed this as a lowlight, but not now. I feel like I’m working on something accretive that’s mine and not trading time for money. Things have changed.

I find myself eager to whip my laptop open early on a Saturday morning before my daughter wakes. On the other side of the coin, I know I can always peel out early on a Tuesday if I have an appointment. I never really turn “it” off, but I also don’t feel like I need the reprieve. It’s a feminine strain of hustle culture that other millennial female entrepreneurs are all too familiar with.

At the same time, I’ve been more present with my family, which is one of my goals every year now that I’m a parent. Even though I think about my business a lot, I’d describe it as stimulating and not stressful. Think more idea generation and less anxious preoccupation.

Purpose

I also feel like I’m working toward a greater purpose. One of the best parts of 2023 has been working directly with the people (mostly whip-smart women) I want to work with – many of which I’m not sure would have approached a traditional financial advisor for help.

I’m delivering my services in a model that I believe in and feel good about. Sure, I could go be a financial advisor at any big company, but I know I wouldn’t feel nearly as passionate about delivering advice through a business model with too many conflicts of interest.

I’ve actually had other advice professionals express concern that I’m underutilizing my expertise and credentials by working with a target market that is “lower margin.” In other words, I’m not earning as much money working with other women instead of going the higher-net-worth route.

Each one of these exchanges confirms to me that I bring to the table exactly the integrity and expertise that other women like me need when seeking advice.

Mastery

Finally, I’m enjoying working toward mastery of the many skills it takes to run my business, the most important of which is technical financial planning expertise. This is a field undergoing constant change, where there’s always something new to learn. It’s invigorating.

In addition to a fee-only financial planner, I’m a business manager, blog author, marketer, and relationship manager. Wearing multiple hats in 2023 has suited me. I have some range, and unless I’m able to flex different muscles periodically, I get bored. I’ve learned this is something I need to feel satisfied in my career.

I’ve referenced the book Drive by Daniel Pink several times on this blog before. In it, he explains that autonomy, purpose, and mastery are the three ingredients to foster sustained motivation. Now, with my own business, it finally feels like I can sustainably fire on all of these cylinders.

The Lowlights: Mostly Financial

Topping the lowlight chart is the glaring fact that I’m earning much less than I would be had I stayed on a corporate track. Goodbye, salary direct deposits! Goodbye, cash bonuses and RSUs!

I’ve taken a pay cut to the tune of about 75%, which is enough to give me night sweats. With our growing family, we have double the daycare, double the future tuition, all on less income.

Health Insurance

Causing me acute pain right now (figuratively, of course) is how becoming a female entrepreneur has limited my access to health insurance choices. Thankfully, my family has my husband’s high-deductible health insurance plan offered through his employer, but I’d describe his option as a plan that protects you from absolute financial ruin caused by extreme healthcare bills. It’s not a cushy plan with fluffy benefits.

To give you some numbers, we plan to pay about $10,000 out-of-pocket to have a baby this January. That’s even after his company graciously subsidizes $6,000 worth of our deductible through a Health Reimbursement Arrangement (HRA) account. This compares to about $3,600 I paid the first time around when I had employer-sponsored health insurance at a big company.

To be clear, this isn’t to be critical of his employer’s offering. They’re a smaller business negotiating their own challenges in a privatized health insurance hellscape.

Maternity Leave

Maternity leave for self-employed female entrepreneurs also isn’t a thing, so I’ll return to work about a month after the baby arrives.

Not having maternity leave is a double-edged sword. No master waits for me to return from leave, which is freeing. At the same time, I’ll no longer be getting paid when my newborn gets here. If I want to earn money, I have to generate revenue. (So, if you’re seeking financial planning services this spring, hit your girl up.)

Earnings Gap vs. 1st Year in Business?

Finally, but most profoundly, my timing has me questioning what type of statistic I’ve become. Am I a female entrepreneur, in her first trying year of business? Or am I a mother who has fallen susceptible to the slippery slope of the earnings gap that tends to develop right when children enter the picture?

It’s probably a mixture of both.

Starting a business is risky, but it’s a risk I’m comfortable taking. Earning less because I’m a mother who has chosen to change directions is the troubling part. Did I just jump off of an earnings trajectory that I won’t be able to get back on? Perhaps, but I also felt like my career and parenting balance was unsustainable before. (Any mother who has ever questioned their choice to work in or out of the home is all too familiar with this rumination.)

It’s too soon to tell, yet it’s too late to go back. For me, so far, the highlights of being a business owner outweigh the lowlights.

At the end of the day, most of the lowlights have been financial. I have to remind myself that part of the reason I worked and saved so hard in my 20s was to give myself the flexibility to take a risk like I am right now.

Year 2: The Year of Resilience

If my first year in business was one of imperfect beginnings, my second year will be one of resilience.

Statistically, for most small businesses, year one is the hardest part. Data from the Bureau of Labor Statistics shows that about 20% of new businesses fail within their first year. In subsequent years, about 5-10% of those businesses continue to fail.

As I prepare to become a mother for a second time, the most challenging part lies ahead of me. Aside from having my husband as a wonderful partner and a very supportive family, I feel like the odds are stacked against me as a female entrepreneur. Between the earnings gap, not having maternity leave, limited health insurance choices, expensive childcare, and just generally being extremely hard to start a successful business…it feels like trying to put in a ponytail with one hand.

Yet, I think if you want to live a fulfilling life, you have to choose your “hard.” Right now, my version of hard is choosing to start a business with young children. In an alternate reality, it could have been a demanding corporate job that came with an inverse (but equally difficult) set of challenges.

Regardless of what’s ahead of me, I have to remember to look back at all I’ve accomplished in 2023. In many ways, getting started was the hardest part. Now, I’ve generated momentum that wouldn’t exist had I waited. I‘ve learned some valuable lessons and worked with wonderful clients who I’ve helped in ways that I’m extremely proud of.

Here’s to 2024 and all of the opportunities, challenges, change, and excitement that lies ahead!

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.