Women are disproportionately impacted by inflation. Here are 3 ways it may be impacting you and what you can do about it.

Summer forecast: cloudy with a chance of inflation.

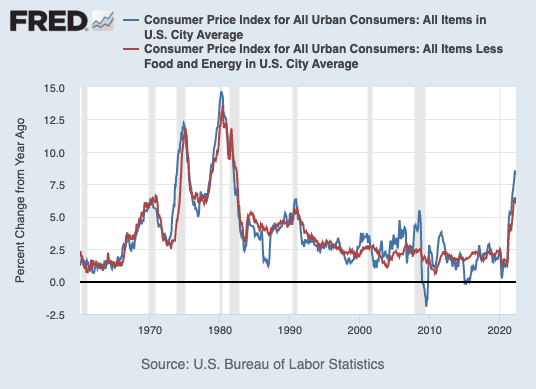

The annual inflation rate in the U.S. reached 8.6% at the end of May 2022, marking the greatest increase in prices since 1981. 🍌🚀 This means that every $1,000 you had in your savings account in 2021 is worth closer to $910 in 2022, if it’s still saved there.

When the dollar experiences inflation, it loses value and purchasing power. The same $1 buys less and less over time as prices creep up.

Normally, inflation seeps in gradually, like death by a thousand paper cuts over several years. But this year, it felt more like a slap in the face.

Aside from being the highest inflation experienced in 40 years, we’re closing a period in which inflation has been (stubbornly) low. Over the past decade, the highest annual inflation was 2.3% in 2019. On the lower end, it touched 0.8% in 2014 and 0.7% in 2015.

Some inflation is actually good. In fact, The Fed (the people that set interest rates) has an inflation target of 2% per year. A modest amount of inflation means prices are relatively stable but your money will still be worth less in the future.

This is key. Money becoming less valuable over time incentivizes you to spend it now. This helps keep the economy moving.

Why is it so high? The inflation perfect storm.

The U.S. (and most major economies abroad, for that matter) are experiencing a perfect storm to create inflation.

Demand is high for goods. Following the pandemic, there was an extreme release of pent up consumer demand. In other words, all that stuff we didn’t buy during the pandemic, we’re out there buying it now 🛍 with our newly increased wages and pandemic savings.

Supply is disrupted, plus the cost of inputs has increased. The War in Ukraine has constrained the global supply of oil and other commodities, pushing prices higher, especially for energy. An American worker shortage and stark wage growth have also contributed to higher cost of goods and experiences.

What does inflation mean for my money?

(1) Bake an extra 10-15% into your budget.

Purchases will continue to get more expensive until inflation slows. Certain areas of your spending have been hit worse than others. Gas prices lead the way, with the national average price per gallon at $5 as of June, 2022. In addition to what you pay to fill your car, oil and gas prices impact virtually every good produced in America.

Groceries are a painful second. Things like meat and fresh produce increased over 14% in price since last year at this time. Tough time to be Paleo, no?!

(2) If you’re holding cash, you’re losing value.

If you hold cash, or even other conservative investments like CDs, inflation will eat into your principal and returns. What’s counterintuitive is that “safer” investments (i.e. ones with less risk of price fluctuation) almost guarantee a loss during inflationary times.

*Investment Return – Inflation = Real Return*

You can use the formula above to estimate what your investments actually returned. If you invested your money in something that produced less than 8.6% over the last year, you actually lost money in real return terms, even if your return was positive.

According to a study conducted by Fidelity and summarized in this Motley Fool article, women tend to hold 68% of their portfolios in cash. Men, on the other hand, tend to hold 59% of their portfolios in cash. (For a reference point, professional money managers with a fully-invested mandate only hold 2% cash, on average.)

This means inflation disproportionately impacts women. Because women tend to hold more conservative investments on average, we have a lower chance of out earning inflation with our investments. Over the long haul, this is devastating. Women are missing the chance to build wealth.

(3) Inflation benefits fixed-rate borrowers.

Herein lies the silver lining. If you’re a borrower with a fixed, monthly payment, inflation actually benefits you.

To take the inverse of the example above, if you had a $1,000 monthly mortgage payment before, you’re still paying that same fixed dollar amount, but it’s really only worth $910 now. 🤯

In the perennial debate to pay off your mortgage or not, this definitely supports the argument to keep your fixed-rate mortgage instead of paying it off. Over a 30-year time period, your payment stays fixed while money loses purchasing power.

You may have also incidentally timed your fixed rate borrowing justttt right, if you took out a loan over the past few years. If the 1980s is any precedent, high inflation led to high interest rates for most of the decade. Chances are decent that borrowing costs are going to be higher over the next several years than they have been since 2008.

How do I protect myself from inflation?

I take a two-pronged approach to managing inflation: (1) grow my earned income, and (2) invest my assets.

When negotiating pay raises, research recent inflation statistics. If your boss is selling you on how great your 10% annual raise was, you might politely remind her that it was more like 1.4% after inflation.

On the investing front, the antidote to combat inflation is investing in asset classes that can return more than inflation over the long run. I’m looking at you, stock market.

The giant caveat here is that you need to have a long-term time horizon (at least 10 years) until you want to use the invested money to make this a smart strategy. The longer you’re invested, the better your chances of earning a positive return.

If your time horizon is shorter, this is a more complex decision. The stock market alone likely won’t be the right choice for you.

Instead, investments that have more price stability but can still offset some inflation, like bonds, may be a better fit. After all, the long-term inflation rate in the U.S. is closer to 3%.

Lastly, continue to keep your emergency fund in cash-like investments (i.e. savings account, high-yield savings) that are readily available in case of emergency. In case you need money on short notice, it’s best to keep 3-6 months of living expenses in “investments” that aren’t going to fluctuate.

Thanks for reading.🤗

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments may be appropriate for you, consult with your financial advisor.